The cryptocurrency landscape is about to witness a groundbreaking event that promises to reshape the industry’s dynamics and offer a glimpse into the future of decentralized finance.

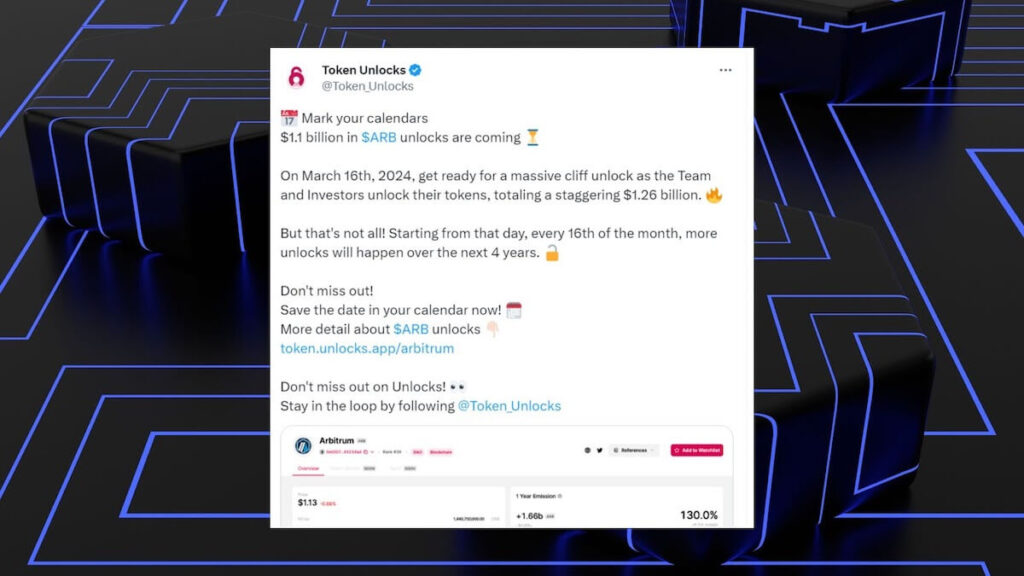

On March 16, 2024, Arbitrum, a cutting-edge layer 2 scaling solution, is poised to unlock a staggering 1.11 billion ARB tokens, sending excitement and anticipation throughout the blockchain community. This landmark event marks a pivotal step forward for the protocol, unleashing a potential tidal wave of liquidity that could spark new opportunities and innovations within decentralized applications.

Table of Contents,

- 1 A Glimpse into the World of Arbitrum

- 2 The March 16 Milestone: A Game-Changer

- 3 The Methodology Behind the Unlock

- 4 The Ripple Effect: Unleashing Liquidity and Price Implications

- 5 The Analytical Perspective: Unlocks and Price Action

- 6 Unlocking Innovation: A Bright Future Ahead

- 7 In Conclusion: March 16 Marks the Dawn of a New Era

A Glimpse into the World of Arbitrum

Arbitrum, designed as a scalable and cost-effective smart contract solution, has garnered widespread attention for its ability to tackle the scalability and congestion issues that have long plagued the Ethereum network. With Ethereum’s soaring popularity and usage, the need for efficient scaling solutions has never been more pressing. Enter Arbitrum is a beacon of hope that aims to revolutionize our interactions with decentralized applications.

The March 16 Milestone: A Game-Changer

Come March 16, 2024, the cryptocurrency world will witness a monumental unlocking event. The protocol is set to execute a “cliff unlock” of a staggering 1.11 billion ARB tokens, which holds profound implications for the project’s future trajectory. At the prevailing market rate of $1.12 per token, this release translates to an impressive $1.24 billion worth of unlocked tokens. Notably, this figure represents a substantial 87% of the circulating supply of 1.275 billion ARB tokens, a testament to the magnitude of this unlocking event.

The Methodology Behind the Unlock

Unlocks, as the name suggests, involve gradually releasing previously frozen cryptocurrency tokens. These releases are meticulously planned and strategically executed to prevent sudden influxes of liquidity that could disrupt market stability. The “cliff unlock” strategy, employed by Arbitrum, involves immediately releasing a predetermined number of tokens after a stipulated period. After this initial release, the unlocking process transitions to a linear schedule, allowing for a controlled and measured increase in token circulation.

The Ripple Effect: Unleashing Liquidity and Price Implications

Unlocking tokens has significant implications for a cryptocurrency’s liquidity and market dynamics. This event is often viewed as a “bearish catalyst,” potentially exerting downward pressure on the token’s price. The rationale behind this notion lies in the fact that unlocked tokens flood the market, thereby increasing the available supply. As a result, the delicate balance between supply and demand could tilt, potentially leading to price corrections.

The Analytical Perspective: Unlocks and Price Action

A study by The Tie, a prominent analytics firm, delves into the relationship between token unlocks and price action. The findings of this study shed light on the critical threshold of unlocks that could impact token prices. Specifically, unlocks exceeding 100% of a token’s average daily trading volume tend to exert a notable influence on the token’s price trajectory. This insight underscores the significance of measured and well-calibrated unlock strategies.

Unlocking Innovation: A Bright Future Ahead

While unlock events can exert short-term effects on token prices, they also serve as opportunities to bolster a project’s innovation and growth. By unlocking a substantial portion of tokens, projects like Arbitrum can incentivize network participation, foster developer engagement, and catalyze the creation of new use cases.

Thus, while the short-term effects of unlocking tokens are worth considering, it is essential to recognize the broader implications for the project’s long-term success and sustainability.

In Conclusion: March 16 Marks the Dawn of a New Era

As the crypto world eagerly awaits March 16, 2024, unlocking 1.11 billion ARB tokens on Arbitrum’s layer 2 scaling solution represents a milestone beyond immediate market dynamics.

This event underscores the resilience and potential of blockchain technology to address scalability challenges and foster a new wave of innovation. While the unlock may bring short-term volatility, its lasting impact on the project’s growth and adoption could shape the trajectory of decentralized finance for years to come. As we stand on the cusp of this transformative event, one thing is clear: Arbitrum’s unlock is not just about tokens; it’s about unlocking the boundless possibilities of a decentralized future.