In a stunning turn of events, the cryptocurrency markets experienced a seismic shock as Bitcoin, the flagship digital currency, underwent a flash crash that erased over $1 billion in what many have termed ‘speculative excess’ from the market. This dramatic event has sparked intense debate among investors, analysts, and enthusiasts about the nature of speculation in the cryptocurrency markets and the inherent volatility of digital assets. This article delves into the dynamics of the flash crash, exploring its causes, consequences, and the critical lessons it imparts on the cryptocurrency ecosystem.

Table of Contents,

Unpacking the Flash Crash

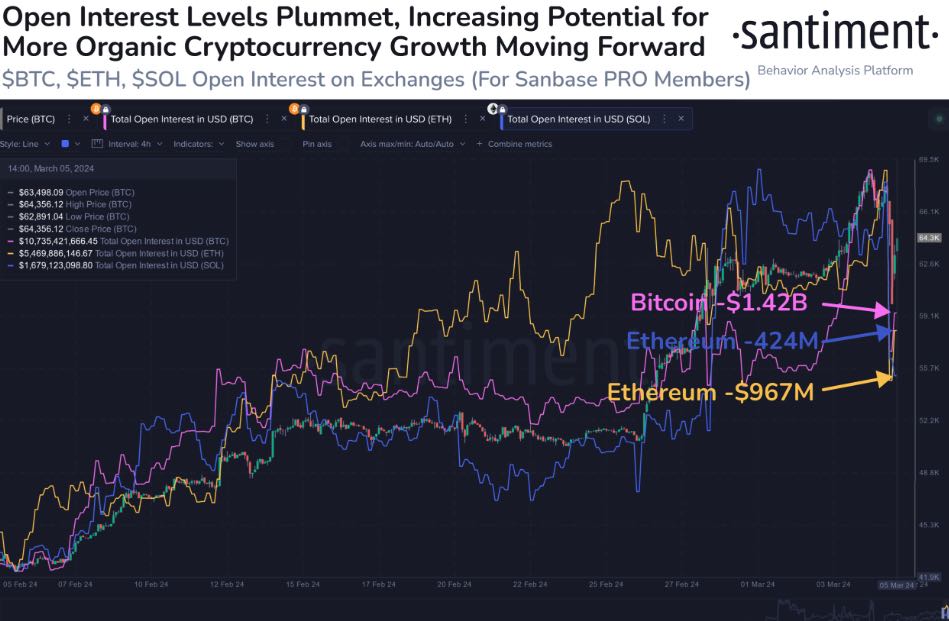

A flash crash refers to a very rapid, deep, and volatile drop in an asset’s price, which is usually followed by a swift recovery. Bitcoin’s recent plummet is not the first of its kind in the volatile crypto markets, but its impact was particularly pronounced, wiping out significant speculative gains in a matter of hours. Several factors contributed to this precipitous drop, including leveraged positions being liquidated, market sentiment turning bearish, and a cascade of stop-loss orders being triggered.

Speculative Excess in the Spotlight

The term ‘speculative excess’ has been widely used to describe the frothy conditions that led up to the crash. In the weeks preceding the event, Bitcoin and other cryptocurrencies saw massive inflows of capital, much of it driven by speculation rather than fundamental investment rationale. Leverage, which allows investors to borrow funds to amplify their investment, reached unsustainable levels, setting the stage for a market correction.

The Role of Leverage and Liquidations

One of the key catalysts for the flash crash was the unwinding of leveraged positions. As the price of Bitcoin began to fall, it triggered a domino effect of liquidations, where leveraged positions were automatically closed to prevent further losses. This selling pressure compounded the downward movement, exacerbating the crash’s depth and speed.

Immediate Consequences and Market Response

The immediate aftermath of the flash crash saw a mixed response from the market. On one hand, the rapid price recovery that followed demonstrated the resilience and liquidity of the cryptocurrency markets. On the other hand, the wipeout of $1 billion in market value served as a stark reminder of the risks associated with high levels of speculation and leverage.

Lessons for the Future

The flash crash serves as a critical lesson for investors, regulators, and the cryptocurrency community at large. It underscores the importance of prudent investment practices, such as due diligence, risk management, and the avoidance of excessive leverage. For regulators, the event highlights the need for clearer guidelines and protective measures for investors to navigate the volatile crypto markets safely.

Moreover, the crash reiterates the importance of building a market driven by fundamental value rather than speculative frenzy. As the cryptocurrency ecosystem continues to mature, fostering a culture of informed investment and responsible trading practices will be essential for its long-term stability and growth.

Conclusion

Bitcoin’s flash crash and the subsequent wipeout of $1 billion in speculative excess from the markets have ignited a crucial conversation about the nature of speculation, the risks of leverage, and the need for responsible investing in the cryptocurrency space. While the recovery from the crash demonstrates the market’s resilience, it also serves as a cautionary tale. The cryptocurrency community must heed the lessons of this event, advocating for practices that ensure the healthy and sustainable development of the digital asset market.