In the volatile world of cryptocurrency, a 14% correction can unsettle many, but seasoned Bitcoin traders remain cautiously optimistic. Despite the recent downturn, which has seen Bitcoin retract significantly from its highs, professional traders are not hitting the panic button just yet. Instead, they’re analyzing the market with a long-term perspective, underpinning their resilience and bullish outlook. This article delves into why, despite a significant correction, pro Bitcoin traders maintain a positive stance and what this means for the cryptocurrency market.

Table of Contents,

The 14% Correction: A Closer Look

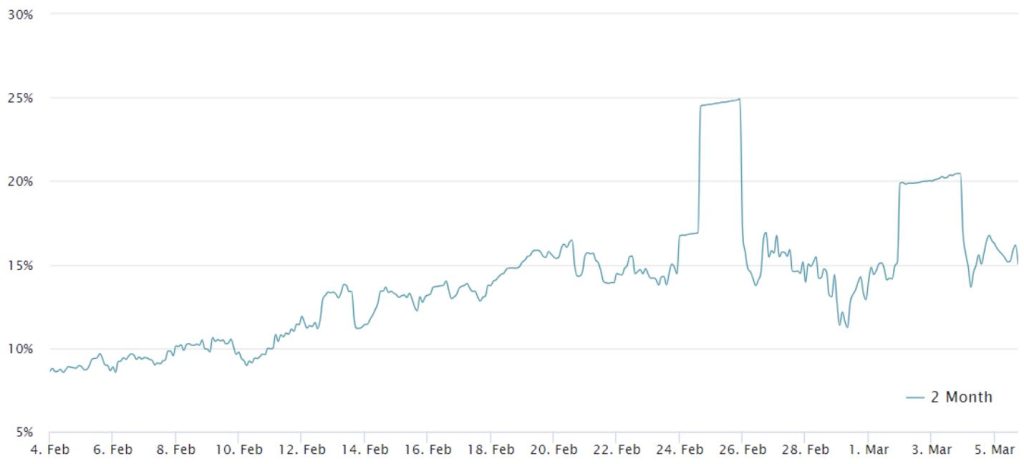

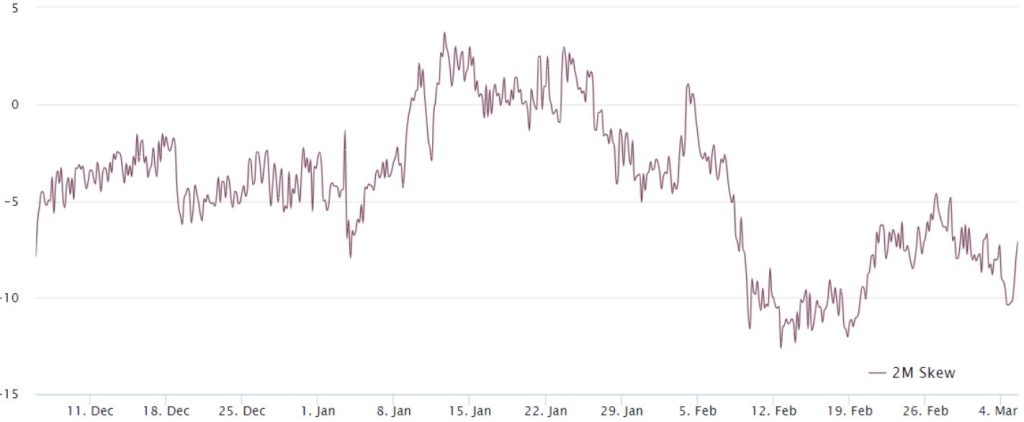

Market corrections, while daunting, are not uncommon in the cryptocurrency realm. Bitcoin, known for its price volatility, has experienced numerous fluctuations throughout its history. The recent 14% drop is the latest in this trend, triggered by a combination of factors including regulatory news, market sentiment shifts, and macroeconomic variables. However, rather than signifying a market downturn, seasoned traders view these corrections as natural market cycles, essential for sustaining long-term growth.

Pro Traders’ Bullish Stance: Understanding the Optimism

Pro Bitcoin traders’ optimism amidst the correction is not baseless but grounded in several key observations:

- Historical Resilience: Bitcoin has shown remarkable resilience over the years, bouncing back from more severe corrections. Professional traders often look at historical data to gauge potential market recovery patterns.

- Market Fundamentals: Despite short-term price movements, the fundamentals of Bitcoin and the broader cryptocurrency market remain strong. Increasing adoption rates, advancements in blockchain technology, and growing interest from institutional investors contribute to a positive long-term outlook.

- Buying Opportunities: Corrections often present buying opportunities for those looking to enter the market or increase their holdings at a lower price point. Savvy traders use these periods to strategically augment their positions.

- Diversification Strategies: Professional traders typically employ diversification strategies to mitigate risk. By spreading investments across multiple assets, they can better absorb the impact of a single asset’s price correction.

In maintaining their cautiously optimistic stance, pro traders employ several strategies to navigate market corrections effectively:

- Technical Analysis: Utilizing technical analysis tools to identify potential support and resistance levels, helping inform buy or sell decisions.

- Risk Management: Implementing strict risk management protocols, including the use of stop-loss orders to protect against significant losses.

- Long-Term Perspective: Focusing on long-term investment horizons, understanding that short-term volatility is part and parcel of the cryptocurrency market.

Conclusion

The recent 14% correction in Bitcoin’s price has tested the mettle of investors and traders alike. However, pro Bitcoin traders remain cautiously bullish, viewing the dip as a temporary setback in a market known for its cyclical nature. Their optimism, grounded in experience, market analysis, and strategic positioning, serves as a reminder of the importance of perspective in the high-stakes world of cryptocurrency trading. As the market continues to evolve, the ability to maintain a level head and a clear strategy will distinguish the successful traders from the rest.