In a recent interview on FOX Business, BlackRock CEO Larry Fink made a statement that sent shockwaves through the cryptocurrency world. Fink labeled Bitcoin (BTC) as a “digital asset” and, even more notably, compared it to the precious gold. He went on to explain that BTC could serve as an international alternative asset to gold, sparking further interest in the digital currency. This declaration comes on the heels of BlackRock’s application for a Bitcoin ETF (exchange-traded fund) and Nasdaq’s inclusion of a Coinbase surveillance sharing agreement (SSA) in a spot Bitcoin ETF filing. In this article, we will delve into the significance of Fink’s endorsement and how it could pave the way for the democratization of cryptocurrency.

Table of Contents,

Bitcoin: The New Digital Gold

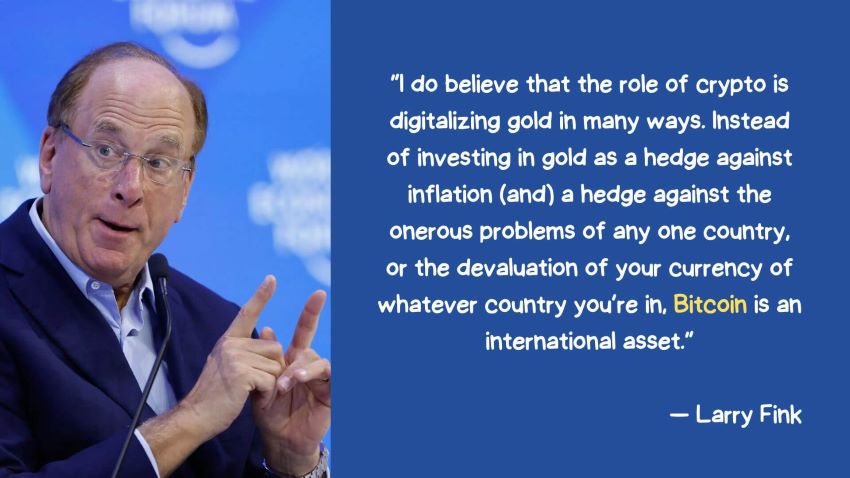

Larry Fink’s characterization of Bitcoin as “digital gold” carries profound implications. Gold has been the best traditional store of value for centuries, known for its stability and resilience amid economic uncertainties. Fink’s comparison suggests that Bitcoin possesses similar qualities, making it a formidable contender in the investment world.

The comparison to gold also underscores Bitcoin’s growing acceptance among institutional investors. Just as gold has been a staple in portfolios to hedge against inflation and economic downturns, Bitcoin is emerging as a modern, digital counterpart to achieve the same goals. As a result, more investors are interested in diversifying their portfolios with cryptocurrencies, recognizing the potential for long-term value.

BlackRock’s Bitcoin ETF Application

BlackRock, the world’s largest asset manager, recently applied for a Bitcoin ETF. This move signifies a major step towards bringing cryptocurrency into the mainstream financial market. ETFs are investment vehicles offering exposure to various assets, making it possible and easy for traditional investors to participate in the cryptocurrency market without directly owning digital coins.

If approved, BlackRock’s Bitcoin ETF would provide investors with a regulated and secure way to invest in BTC. This regulatory oversight can alleviate concerns related to fraud and security, attracting a wider range of institutional and retail investors who have been cautious about entering the crypto space.

Nasdaq’s Coinbase Surveillance Sharing Agreement

In parallel to BlackRock’s Bitcoin ETF application, Nasdaq has included a Coinbase surveillance sharing agreement (SSA) in its spot Bitcoin ETF filing. This agreement aims to enhance market surveillance and integrity by allowing regulators access to Coinbase’s trading data. This transparency can instill greater confidence in the cryptocurrency market, sometimes marred by concerns about price manipulation and illicit activities.

By partnering with a reputable cryptocurrency exchange like Coinbase, Nasdaq is taking strides to legitimize the crypto space. This initiative aligns with Larry Fink’s vision to “democratize crypto,” making it accessible and trustworthy for a broader audience.

Democratizing Crypto: What It Means

Larry Fink’s aspiration to “democratize crypto” holds immense promise for the cryptocurrency market. Democratization means making cryptocurrency more accessible, inclusive, and secure for everyone, from institutional investors to the average person on the street.

Firstly, by offering a Bitcoin ETF and establishing surveillance-sharing agreements, BlackRock and Nasdaq are bringing cryptocurrencies closer to regulatory compliance. That creates a safer environment for investors, reducing the risk of fraud and market manipulation.

Secondly, the acceptance of Bitcoin as a “digital gold” by influential figures like Larry Fink can encourage more people to explore cryptocurrencies. That can lead to increased adoption, ultimately benefiting the entire crypto ecosystem.

Conclusion

Larry Fink’s assertion that Bitcoin is “digital gold,” BlackRock’s pursuit of a Bitcoin ETF, and Nasdaq’s commitment to transparency through the Coinbase SSA signifies a real shift in the cryptocurrency landscape. These developments can make cryptocurrency more accessible, secure, and appealing to a broader range of investors. As the financial world evolves, embracing digital assets like Bitcoin may be the key to a more diversified and resilient investment future.