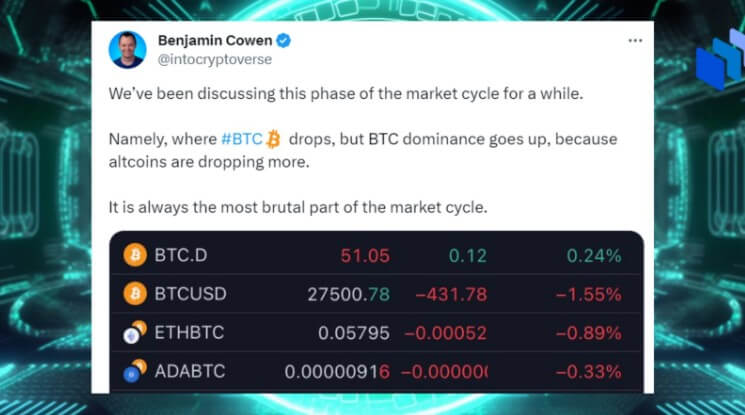

In the cryptocurrency world, the ebb and flow of digital assets are akin to a rollercoaster ride. Recently, Bitcoin (BTC) took a dip, but intriguingly, BTC dominance began to climb. Benjamin Cowen, the CEO/Founder of ITCCrypto and an Engineering PhD, offers insights into this phenomenon, suggesting that it’s a familiar part of the market cycle. But what does it mean, and why is BTC dominance a crucial metric?

We delve into Cowen’s perspective and the thoughts of cryptocurrency market analyst John Nectarios to explore the significance of BTC dominance in navigating the crypto landscape.

Table of Contents,

BTC Drops, Dominance Rises: A Familiar Cycle

Benjamin Cowen’s observation that BTC drops while its dominance rises isn’t just a casual remark; it’s a valuable insight into the cryptocurrency market dynamics. This phenomenon is a recurrent crypto phenomenon, particularly during challenging market phases. While it may seem counterintuitive at first, it’s a testament to the resilience of Bitcoin, often referred to as the “king” of cryptocurrencies.

Historically, BTC has weathered market storms and emerged stronger. These drops in BTC price, accompanied by rising dominance, often coincide with the most brutal parts of the market cycle. It’s a pattern experienced cryptocurrency enthusiasts are familiar with and one that Cowen believes is intrinsic to the crypto ecosystem.

BTC Dominance: The Guiding Metric

John Nectarios, a cryptocurrency market analyst, emphasizes the critical role of BTC dominance in understanding the broader crypto market. He views it as the North Star, guiding investors and enthusiasts through the ever-changing landscape of digital assets. Without a grasp of BTC dominance, one can easily become lost in the maze of altcoins, especially during bear markets.

BTC dominance, in simple terms, represents the percentage of BTC’s total cryptocurrency market capitalization. When this metric rises, BTC’s market cap is growing relative to the rest of the cryptocurrency market. That can happen for various reasons, including increased investor confidence in BTC’s long-term potential and a flight to safety during turbulent times.

The Hot Sale VS Concerns

As Cowen pointed out, the recent drop in BTC price and the subsequent rise in BTC dominance have sparked mixed reactions within the crypto community. Some users see this market situation as a “hot sale,” an opportunity to accumulate more BTC at a lower price. For them, it’s a strategic move to capitalize on the dip.

However, it’s essential to acknowledge that even more users are concerned about the broader implications of this trend. They view it as a signal of uncertainty in the altcoin market, potentially indicating that investors are returning to BTC as a haven. While this may boost BTC’s dominance, it also raises questions about the health and vitality of the broader cryptocurrency ecosystem.

You might also be interested: Bitcoin Halving Countdown Goes Live

Conclusion

In a crypto market characterized by constant fluctuations and wild price swings, understanding BTC dominance is like having a compass in a dense forest. Benjamin Cowen’s observation of BTC dropping while dominance rises is a reminder that crypto cycles are as predictable as they are volatile.

As John Nectarios aptly puts it, grasping BTC dominance is essential for navigating the “crypto cycle narrative.” It provides valuable insights into market sentiment, trends, and the shifting dynamics between BTC and altcoins. While some may see it as a hot sale and others as a cause for concern, one thing remains clear: BTC’s dominance is a metric that all crypto enthusiasts should keep a close eye on as it guides us through the exciting and ever-changing world of assets in the digital plane.