In the volatile realm of cryptocurrency, the security of blockchain networks is paramount. A recent study by Coin Metrics has ignited a significant discussion within the crypto community by presenting evidence that Bitcoin (BTC) and Ethereum (ETH) are, in fact, immune to the much-feared 51% attacks. This assertion challenges the pervasive anxiety surrounding potential vulnerabilities in these leading digital currencies. As we delve into the intricacies of Coin Metrics’ research, decentrahacks.com aims to explore the argumentative sides of this revelation, evaluating the implications for BTC, ETH, and the broader cryptocurrency ecosystem.

Table of Contents,

Understanding 51% Attacks

A 51% attack occurs when a single entity or group gains control of more than half of a blockchain network’s mining hashrate, thereby obtaining the power to manipulate transaction confirmations. This can lead to double-spending, where the attacker spends the same digital currency twice, undermining the blockchain’s integrity and trustworthiness.

The Case for BTC and ETH’s Immunity

Coin Metrics’ research posits that BTC and ETH have developed robust defenses against 51% attacks, primarily due to their:

- Decentralized Mining Operations: Both Bitcoin and Ethereum boast highly decentralized networks of miners across the globe, making it exceedingly difficult and economically unfeasible for any single actor to amass over 50% of the mining power.

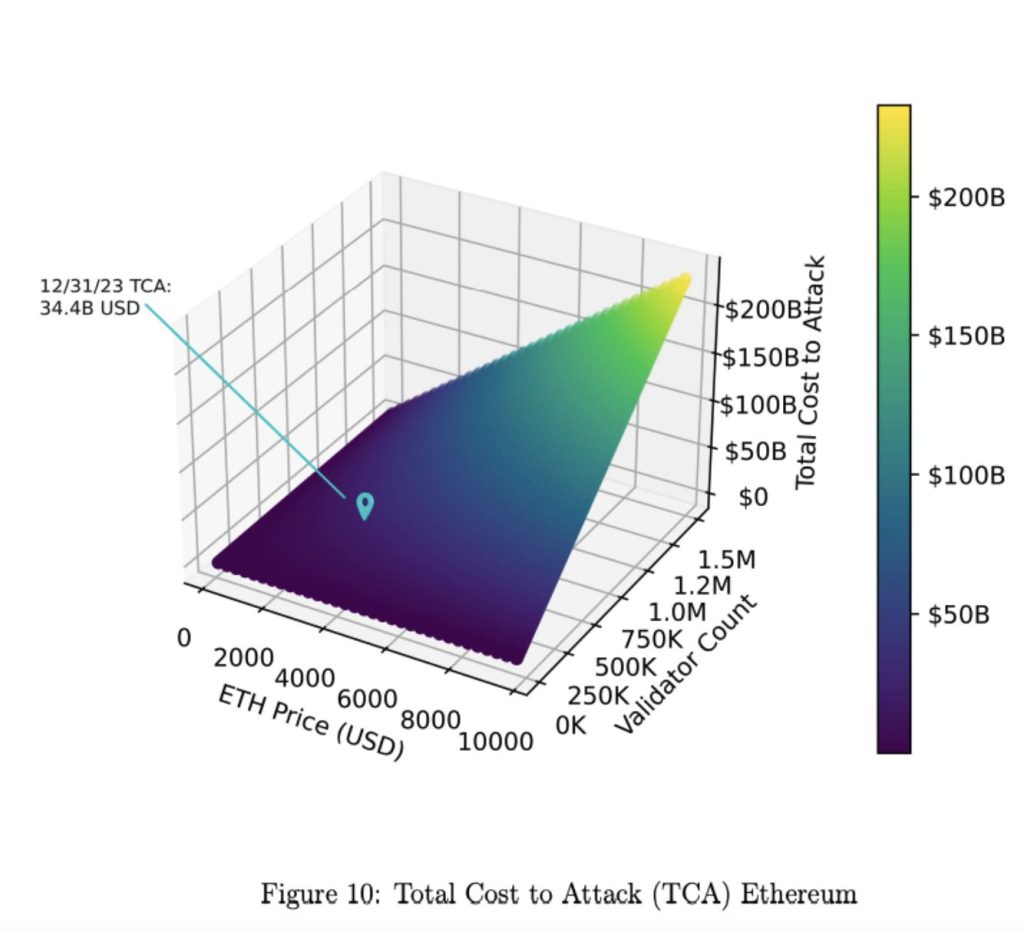

- Economic Disincentives: The sheer financial investment required to attempt such an attack on these networks, considering the cost of hardware and electricity, coupled with the low probability of success, creates a significant economic disincentive for potential attackers.

- Proof of Stake (PoS) Transition: Ethereum’s transition to a PoS consensus mechanism further diminishes the risk of a 51% attack. In a PoS system, the amount of cryptocurrency a person holds and is willing to “stake” as collateral determines their mining power, thereby reducing the likelihood of any single entity gaining majority control.

Counterarguments and Concerns

Despite Coin Metrics’ findings, some experts maintain a cautious stance, highlighting that:

- Evolving Attack Vectors: As blockchain technology advances, so do the methods of exploitation. Critics argue that immunity to 51% attacks today does not guarantee safety tomorrow, as attackers continuously seek new vulnerabilities.

- Centralization Risks: Concerns persist about the gradual centralization of mining operations within both networks, particularly as smaller miners exit the market. This could, theoretically, make it easier for larger mining pools to collaborate towards a majority control.

- Complacency Dangers: There’s a fear that labeling BTC and ETH as “immune” to 51% attacks might breed complacency among developers and users, potentially overlooking other critical security measures necessary to safeguard the networks.

Conclusion

Coin Metrics’ research provides a compelling argument for the resilience of BTC and ETH against 51% attacks, underscoring the robustness of their decentralized architectures and the economic impracticalities of such attacks. However, the dynamic nature of cybersecurity threats necessitates continuous vigilance and adaptation. While the findings offer reassurance to investors and users of BTC and ETH, they also serve as a reminder of the importance of ongoing security enhancements and community engagement to address and mitigate emerging threats. In the ever-evolving landscape of cryptocurrency, the journey towards absolute security is perpetual, with BTC and ETH leading the charge in demonstrating the potential for resilience in the face of adversity.