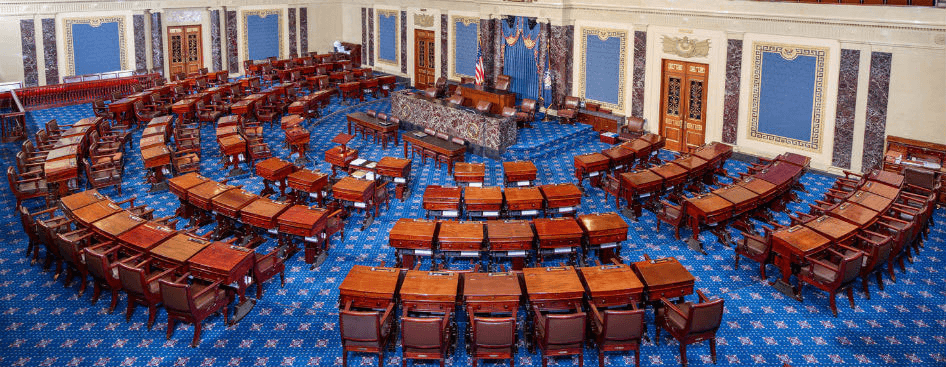

In a rare show of bipartisan unity, nine US lawmakers have rallied behind Senators Elizabeth Warren (D-MA), Roger Marshall (R-KS), Joe Manchin (D-WV), and Lindsey Graham (R-SC) to support the Digital Asset Anti-Money Laundering Act.

This groundbreaking legislation aims to close regulatory gaps and bring cryptocurrency companies in line with anti-money laundering and countering the financing of terrorism (AMF/CFT) standards that govern the traditional financial sector. The bill, backed by diverse organizations, signifies a significant step towards a more secure and transparent crypto ecosystem.

____________________________________________________

You might also be interested:

____________________________________________________

Table of Contents,

- 1 Tackling Crypto’s Regulatory Challenge

- 2 Closing Regulatory Loopholes

- 3 Promoting Transparency and Accountability

- 4 Endorsements from Key Players

- 5 Bipartisan Collaboration for a Safer Crypto Future

- 6 Balancing Innovation and Security

- 7 A Brighter Future for Cryptocurrency

- 8 Conclusion: A Win-Win for Crypto and Regulation

Tackling Crypto’s Regulatory Challenge

Cryptocurrency’s rapid rise has brought many challenges, one of the most pressing being its potential for facilitating money laundering and terrorist financing. The Digital Asset Anti-Money Laundering Act is designed to confront this issue head-on by introducing rigorous regulations to make crypto less susceptible to illicit activities.

Closing Regulatory Loopholes

One of the primary objectives of this legislation is to close existing regulatory loopholes that have allowed some cryptocurrency companies to operate without adequate oversight. Doing so brings the crypto industry more in line with established financial regulations, ensuring a level playing field for all financial service providers.

Promoting Transparency and Accountability

The bill’s provisions also promote transparency and accountability within the cryptocurrency sector. Companies dealing with digital assets will be required to implement robust customer identification and due diligence procedures, making it significantly harder for criminals to exploit the anonymity of cryptocurrencies for illegal purposes.

Endorsements from Key Players

The broad support for the Digital Asset Anti-Money Laundering Act is a testament to its importance and effectiveness. This legislation has garnered endorsements from various organizations, each recognizing the urgent need for stricter crypto regulations.

- Bank Policy Institute: The financial industry’s leading voice acknowledges the importance of aligning cryptocurrency with traditional banking standards to maintain the financial system’s integrity.

- Transparency International US: An organization dedicated to fighting corruption, it sees the bill as a significant step towards reducing financial crimes involving digital assets.

- Global Financial Integrity: Advocates for curtailing illicit financial flows worldwide, recognizing the importance of bringing cryptocurrencies under anti-money laundering regulations.

- National District Attorneys Association: Law enforcement professionals see this bill as a vital tool to combat financial crimes and protect the public.

- Major County Sheriffs of America: Local law enforcement leaders support this legislation to ensure cryptocurrencies do not become tools for criminal enterprises.

- AARP: AARP recognizes the importance of safeguarding the interests of older Americans and supports regulations that protect vulnerable populations from financial exploitation.

- National Consumer Law Center: The NCLC endorses the bill to ensure that even marginalized communities are protected from potential crypto-related fraud.

- National Consumers League: Advocates for consumer rights recognize the importance of regulations ensuring financial transactions’ safety and security in the digital age.

Bipartisan Collaboration for a Safer Crypto Future

The support from lawmakers across the aisle showcases a rare moment of unity in today’s highly polarized political climate. Senators Warren, Marshall, Manchin, and Graham have come together to champion a cause transcending party lines: safeguarding the financial system from illicit activities that cryptocurrencies could enable.

Balancing Innovation and Security

Critics argue that stringent regulations could stifle innovation in the cryptocurrency space. However, the Digital Asset Anti-Money Laundering Act aims for a balanced approach. While it tightens the screws on anti-money laundering measures, it also fosters innovation by providing a clear regulatory framework. This framework can give legitimate businesses the confidence to invest in and develop the next generation of blockchain technologies.

A Brighter Future for Cryptocurrency

As the Digital Asset Anti-Money Laundering Act gains traction among lawmakers and enjoys widespread support from various organizations, it presents a promising outlook for the cryptocurrency industry. By addressing its regulatory challenges, the bill enhances security and sets the stage for responsible growth and innovation within the sector.

Conclusion: A Win-Win for Crypto and Regulation

The backing of Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act by diverse lawmakers and organizations is a testament to the bill’s potential to strike a balance between innovation and security. Robust regulation is essential as cryptocurrencies continue to play an increasingly significant role in our financial landscape. This legislation offers the crypto industry a safer, more transparent, and ultimately more prosperous future. With bipartisan support and a clear focus on closing regulatory gaps, the Digital Asset Anti-Money Laundering Act paves the way for responsible growth and innovation within the digital asset space.