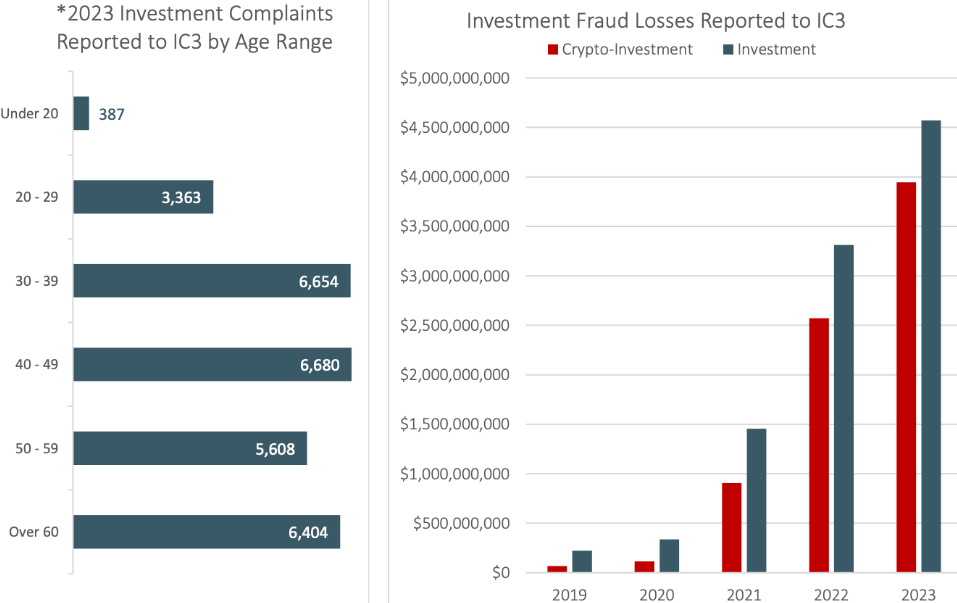

In a startling revelation by the Federal Bureau of Investigation (FBI), investment fraud related to cryptocurrencies has witnessed a significant surge, escalating by 53% in 2023. This alarming uptick underscores the darker side of the digital asset revolution, posing serious concerns for investors navigating the volatile crypto markets. As enthusiasts and investors are drawn to the allure of high returns in the cryptocurrency domain, the shadow of fraud looms large, demanding a closer examination of its implications and the strategies for mitigation.

Table of Contents,

- 1 The Surge in Crypto Investment Fraud

- 2 Argument 1: The Need for Enhanced Regulatory Frameworks

- 3 Counterargument: Preserving the Essence of Decentralization

- 4 Argument 2: The Role of Education and Awareness

- 5 Counterargument: The Limitations of Education Alone

- 6 Conclusion: Striking a Balance for a Secure Crypto Future

The Surge in Crypto Investment Fraud

The cryptocurrency market, celebrated for its unparalleled opportunities for rapid growth and innovation, has also become a fertile ground for fraudulent schemes. The FBI’s report illuminates the growing sophistication and scale of crypto-related investment scams, challenging the perception of digital currencies as a secure investment frontier. This trend not only affects individual investors but also undermines the credibility and stability of the broader crypto ecosystem.

Argument 1: The Need for Enhanced Regulatory Frameworks

Proponents of stricter regulatory measures argue that the rise in crypto fraud necessitates a robust regulatory framework. The inherently decentralized nature of cryptocurrencies, while a cornerstone of their appeal, complicates the task of governance and oversight. Enhanced regulations, these advocates contend, would establish clearer guidelines for legitimate operations, provide mechanisms for investor protection, and empower authorities to combat fraudulent activities more effectively.

Counterargument: Preserving the Essence of Decentralization

Critics of increased regulation caution against measures that could stifle innovation and encroach on the foundational principles of decentralization and privacy that define cryptocurrencies. They argue that over-regulation could hinder the growth of the crypto market, deter innovation, and diminish the competitive advantage that crypto assets offer. Instead, they advocate for a balanced approach that targets fraudulent actors without imposing undue constraints on the ecosystem.

Argument 2: The Role of Education and Awareness

Beyond regulation, there is a consensus on the critical need for investor education and awareness. Knowledge is a powerful deterrent against fraud, and equipping investors with the tools to recognize and avoid scams is imperative. Educational initiatives, community outreach, and transparent communication from crypto platforms can empower users to make informed decisions and scrutinize investment opportunities more critically.

Counterargument: The Limitations of Education Alone

While the importance of education is undisputed, skeptics highlight its limitations. Scammers continually evolve their tactics, exploiting technological advancements and psychological manipulation with schemes that even savvy investors can find difficult to detect. Therefore, while education is a vital component of fraud prevention, it must be complemented by other measures, including technology solutions and legal enforcement, to be truly effective.

Conclusion: Striking a Balance for a Secure Crypto Future

The 53% increase in crypto-related investment fraud in 2023, as reported by the FBI, serves as a stark reminder of the risks inherent in the digital asset space. Addressing this challenge requires a multifaceted approach that includes stronger regulatory frameworks, enhanced investor education, technological innovations to improve security, and international cooperation to tackle cross-border fraud. Striking a balance between fostering innovation and ensuring investor protection will be paramount in shaping a secure and vibrant future for cryptocurrency investments. For the crypto community and stakeholders at decentrahacks.com, navigating this landscape with caution, diligence, and a proactive stance towards fraud prevention will be critical in safeguarding the potential and promise of digital currencies.