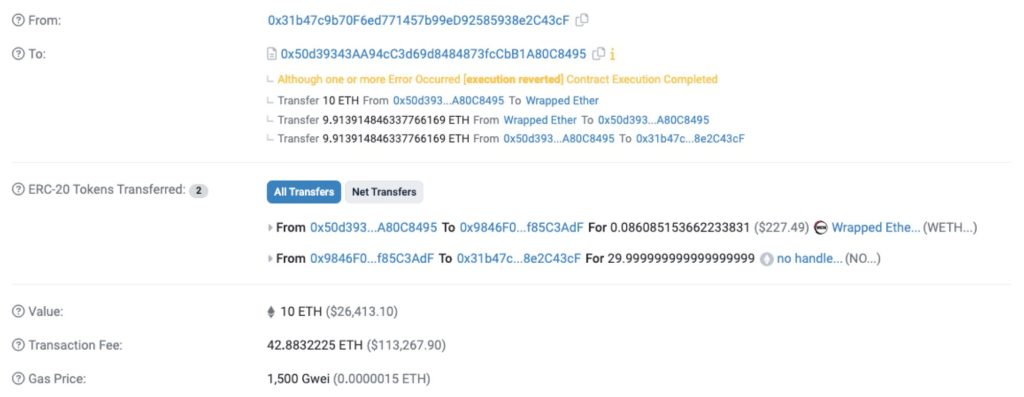

The cryptocurrency market is notorious for its volatility, high rewards, and equally high risks. A recent event where a user spent an astonishing $113,000 in gas fees to snipe a token, only to fall victim to a ‘rug pull,’ has reignited the debate on the sustainability of bull runs and the dangers of FOMO (Fear of Missing Out) in the crypto space. This incident serves as a stark reminder of the precarious nature of chasing potential gains without due diligence. As we dissect this event, decentrahacks.com aims to provide insights into the implications for investors and the broader cryptocurrency market.

Table of Contents,

The Allure of Quick Gains

The crypto market’s potential for rapid gains can often lead to impulsive investment decisions, driven by the fear of missing out on the next big bull run. The user who incurred a $113K gas fee in an attempt to snipe a token represents a broader trend of investors willing to take significant risks for the promise of high returns. This behavior is amplified during periods of market optimism, where the anticipation of a bull run can lead to a frenzy of speculative trading.

The Reality of Rug Pulls

Rug pulls, where developers abruptly remove liquidity from a project, leaving investors with worthless tokens, are a harsh reality in the crypto space. The incident in question underscores the risks associated with speculative investments in unverified or new projects. It highlights the need for thorough research and due diligence before committing substantial resources to any cryptocurrency venture.

The Argument for Caution

Critics argue that incidents like the $113K gas fee debacle are symptomatic of a larger issue within the cryptocurrency market – a tendency towards speculative excess and a disregard for fundamental investment principles. They caution that such behavior not only endangers individual investors but could also undermine the market’s stability and integrity. The argument for caution is grounded in the need for a more measured approach to investing in cryptocurrencies, emphasizing research, risk management, and long-term strategy over short-term speculation.

The Counterargument: Risk and Reward

On the other side of the debate, some maintain that high risk is intrinsic to the nature of cryptocurrency investments and that significant rewards often require the willingness to take on considerable risks. They argue that the decentralized and unregulated nature of the crypto market offers unprecedented opportunities for wealth creation, which, by its nature, comes with the potential for high-stakes failures. For these proponents, incidents like the $113K gas fee are viewed as unfortunate but necessary risks in the pursuit of financial independence and innovation in the crypto space.

Conclusion

The incident of a user spending $113,000 in gas fees only to be ‘rugged’ serves as a cautionary tale in the crypto investment saga. It prompts a necessary reflection on the balance between risk and reward and the importance of informed decision-making in the cryptocurrency market. Whether this event signals the return of a bull run or merely highlights the speculative fervor that often accompanies it, one thing is clear: the path to crypto investment success is fraught with both unprecedented opportunities and pitfalls. As the market continues to evolve, the lessons learned from such incidents will be crucial in shaping a more sustainable and responsible investment landscape.