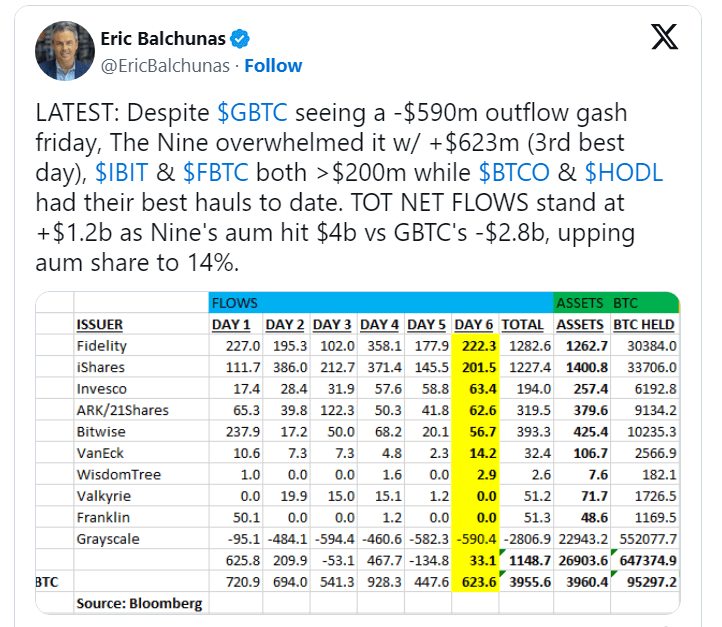

In an astonishing display of market dynamics, Bitcoin Exchange-Traded Funds (ETFs) have amassed an impressive 95,000 BTC in just six days, with their Assets Under Management (AUM) rapidly approaching a staggering $4 billion. This surge in Bitcoin ETFs’ popularity and success has ignited a fiery debate within the cryptocurrency community. Is this meteoric rise a sign of healthy market maturation, or a bubble waiting to burst?

Table of Contents,

The Bullish Perspective: A Sign of Maturing Market

Proponents of Bitcoin ETFs argue that this phenomenal growth signifies the maturing of the cryptocurrency market. They contend that ETFs represent a mainstream acceptance of Bitcoin as a legitimate investment vehicle, akin to gold or stocks. ETFs provide a regulated and accessible avenue for institutional and retail investors to gain exposure to Bitcoin without the complexities of direct cryptocurrency ownership. This, in turn, could lead to increased liquidity, reduced volatility, and enhanced price discovery in the Bitcoin market.

The Skeptical Viewpoint: Fears of a Bubble

On the flip side, skeptics raise concerns that the rapid accumulation of Bitcoin by ETFs might be fueling a speculative bubble. They point out that while ETFs make Bitcoin investment more accessible, they also detach investors from the underlying asset, potentially leading to mispricing and market irrationality. Furthermore, skeptics worry about the potential impact of regulatory changes on Bitcoin ETFs, which could lead to sudden and significant market corrections.

Impact on Bitcoin’s Price and Volatility

One immediate effect of the Bitcoin ETFs’ growth is its impact on Bitcoin’s price and volatility. While some analysts believe that the influx of institutional money via ETFs could stabilize Bitcoin’s price, others fear that it could lead to greater price swings, especially if large ETFs decide to buy or sell their holdings abruptly.

The Regulatory Perspective

The regulatory environment is another crucial factor in this debate. The approval and success of Bitcoin ETFs indicate a growing recognition and acceptance of cryptocurrencies by regulatory bodies. However, this also means that Bitcoin ETFs are subject to regulatory risks, including potential clampdowns or policy shifts that could affect their performance.

Conclusion: Proceed with Caution

The rapid growth of Bitcoin ETFs, while indicative of the increasing mainstream acceptance of cryptocurrencies, also brings to light concerns about market stability and regulatory uncertainty. Investors and enthusiasts should approach this development with cautious optimism, staying informed and vigilant about the evolving market dynamics.