Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), has been a pivotal figure in shaping the regulatory landscape of cryptocurrencies. His decision not to halt the launch of a spot Bitcoin Exchange-Traded Fund (ETF) has raised eyebrows and questions. This article explores the potential reasons behind Gensler’s decision and its implications for the cryptocurrency market.

Table of Contents,

Background

Gensler, known for his expertise in financial regulation, has been vocal about the need for increased oversight in the crypto market. The SEC’s role in approving or rejecting ETF proposals places it at the heart of how cryptocurrencies interact with mainstream financial markets.

The Decision Not to Halt the ETF

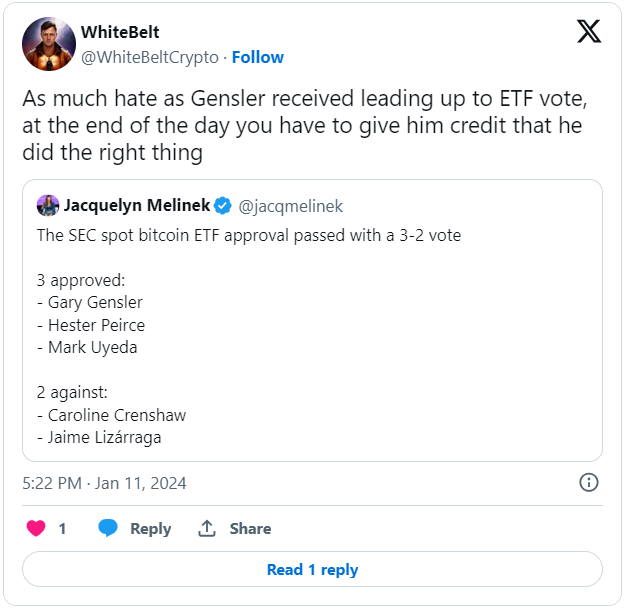

Despite having the authority to stop the launch of a spot Bitcoin ETF, Gensler chose not to. This decision is significant, given his stance on stringent regulations for digital assets.

Possible Reasons for Gensler’s Decision

- Market Maturity:

- Gensler might believe that the cryptocurrency market, particularly Bitcoin, has matured enough to handle the implications of a spot ETF. This maturity could indicate a lower risk of market manipulation, which has been a longstanding concern for the SEC.

- Institutional Interest:

- The growing interest from institutional investors in Bitcoin might have played a role. Institutions tend to bring a level of stability and credibility, which could have assuaged some of the SEC’s concerns.

- Global Competitive Pressure:

- The international market is moving forward with cryptocurrency integration. Gensler’s decision might reflect a strategic move to keep the U.S. competitive in the global financial landscape.

Counterargument – The Risks Remain

Despite these reasons, critics argue that the risks associated with cryptocurrencies remain high. They point to the volatility, lack of investor protection, and potential for market manipulation as reasons why the SEC should have been more cautious.

Conclusion

Gary Gensler’s decision not to halt the spot Bitcoin ETF opens a new chapter in cryptocurrency regulation. While it reflects a possible acknowledgment of the market’s maturity and global pressures, it also highlights the ongoing debate about the balance between innovation and investor protection. As the crypto market continues to evolve, these decisions will shape its trajectory and its relationship with regulatory bodies.