The world of cryptocurrency ETFs is in a state of flux, with recent developments raising intriguing questions about the direction of the market. In one corner, we have the highly anticipated Fidelity Ether ETF, which faces delays in its approval process. In the other, a flood of bids for leveraged Bitcoin ETFs is making waves. In this article, we unravel the dynamics of these two contrasting narratives and their implications for the cryptocurrency landscape.

Table of Contents,

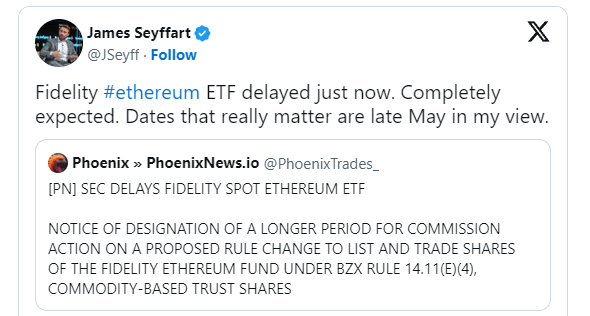

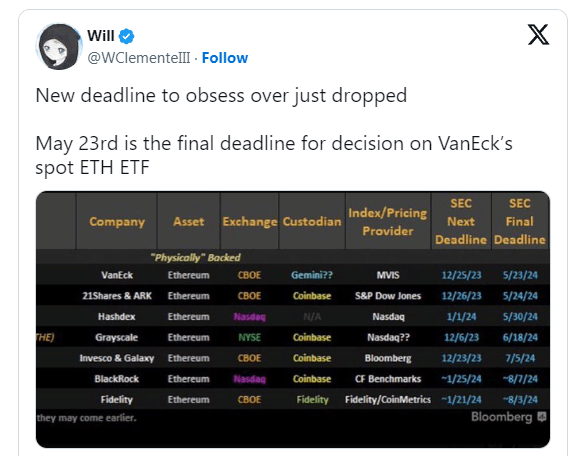

The Fidelity Ether ETF: Awaiting Regulatory Green Light

Fidelity, a major player in traditional finance, has ventured into the crypto space with its Ether ETF proposal. However, the road to approval has been met with regulatory hurdles and delays. The crypto community eagerly awaits the potential launch of this ETF, which could significantly impact the Ether market.

Leveraged Bitcoin ETF Bids: A Surging Demand

On the other side of the spectrum, leveraged Bitcoin ETFs are gaining momentum. Market participants are flocking to bid on these ETFs, driven by the allure of amplified returns in the highly volatile Bitcoin market. The influx of bids signals a growing appetite for sophisticated investment vehicles in the crypto sector.

Regulatory authorities play a crucial role in shaping the destiny of crypto ETFs. The delay of the Fidelity Ether ETF highlights the complexities of obtaining regulatory approval in the cryptocurrency space. Meanwhile, the surge in leveraged Bitcoin ETF bids underscores the need for clear guidelines to protect investors.

Investor Perspective: Risk vs. Reward

Investors find themselves at a crossroads. The Fidelity Ether ETF promises exposure to the world’s second-largest cryptocurrency but is hampered by regulatory uncertainties. On the flip side, leveraged Bitcoin ETFs offer amplified returns but come with increased risk. Deciding where to allocate capital requires a careful assessment of risk and reward.

Market Impact: Shaping Crypto’s Future

The fate of these ETFs extends beyond individual investments. Their approval or delay can influence market sentiment, liquidity, and the overall trajectory of the crypto market. The decisions made in this arena have far-reaching implications.

As the crypto ETF landscape evolves, investors, regulators, and market participants must navigate a landscape filled with promise and uncertainty. The delay of the Fidelity Ether ETF and the surge in leveraged Bitcoin ETF bids serve as a microcosm of the broader challenges and opportunities within the crypto space.