The cryptocurrency market is no stranger to turbulence, and the SatoshiVM token is the latest to experience a significant dip, plummeting as much as 38%. The root cause? Controversy surrounding the Ape Terminal platform. In this article, we’ll dissect the factors contributing to SatoshiVM’s decline, the controversies surrounding Ape Terminal, and whether this dip is an opportunity or a red flag.

Table of Contents,

SatoshiVM Token: A Brief Overview

SatoshiVM is a cryptocurrency token that has gained attention for its unique approach to blockchain technology. With a vision to revolutionize virtual machines on the blockchain, SatoshiVM had been on an upward trajectory, garnering interest from investors and enthusiasts alike.

The Ape Terminal Controversy

The recent dip in SatoshiVM’s value can be attributed to the controversy surrounding Ape Terminal, a platform that aimed to integrate with SatoshiVM. Allegations of mismanagement, regulatory concerns, and security issues emerged, causing panic among investors and raising questions about the partnership.

Market Reaction and Investor Sentiment

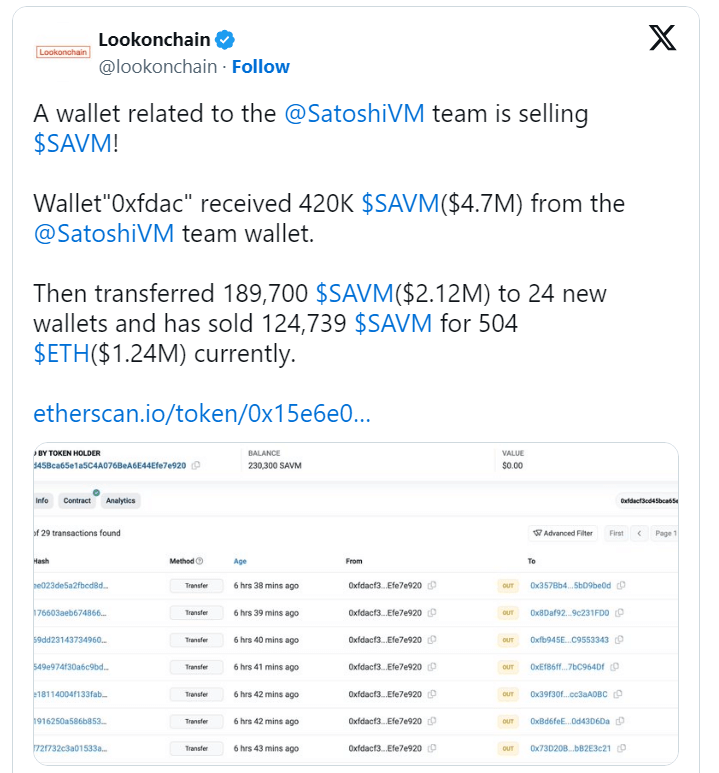

The cryptocurrency market is highly sensitive to news and sentiment. As reports of the Ape Terminal controversy spread, it triggered a swift and substantial sell-off of SatoshiVM tokens. Investor sentiment turned bearish, leading to a sharp decline in its price.

Risk vs. Opportunity

In times of controversy, the cryptocurrency market often presents a dichotomy of risk and opportunity. While the dip in SatoshiVM’s price may appear alarming, some investors view it as a potential entry point. The question remains: Is this dip an opportunity to accumulate SatoshiVM tokens at a discount, or a sign of deeper issues?

Importance of Due Diligence

The SatoshiVM-Ape Terminal controversy underscores the critical importance of due diligence in the cryptocurrency space. Investors must thoroughly research projects, partnerships, and teams behind tokens before committing their funds. It serves as a cautionary tale of the risks associated with blind investments.

The Path Forward

As the controversy surrounding Ape Terminal unfolds, the fate of SatoshiVM remains uncertain. The cryptocurrency community will be closely monitoring developments, and the project’s response to the controversy will play a pivotal role in restoring confidence among investors.

Conclusion

The 38% dip in SatoshiVM’s value amid the Ape Terminal controversy is a stark reminder of the inherent volatility and risks in the cryptocurrency market. While some may see potential opportunities in the dip, it’s crucial for investors to exercise caution and conduct thorough research. The SatoshiVM saga serves as a lesson in the importance of vigilance and due diligence when navigating the ever-evolving crypto landscape.