The Securities and Exchange Commission has thrown the doors wide open to public scrutiny by initiating the collection of comments on filings for spot Bitcoin exchange-traded funds (ETFs). This groundbreaking decision, coupled with strategic delays in processing applications, marks a pivotal moment in the regulatory journey of crypto investment instruments.

Table of Contents,

Postponed Decisions: Unraveling the SEC’s Strategic Chess Moves

The recent announcement from the SEC regarding the postponement of decisions on spot Bitcoin ETF applications from the Franklin Templeton and Hashdex funds has sent ripples through the crypto community.

What adds intrigue to this development is not just the delay itself but the fact that the deadline was over a month away. Is this a strategic chess move by the SEC, carefully calculating each step in the regulatory process?

You can access the whole file here.

As the crypto industry eagerly anticipates the outcome, speculation grows around the true motives behind the postponement. Is it an exercise in regulatory caution, a meticulous examination of complex applications, or a part of a broader plan that could reshape the regulatory landscape in the coming weeks?

Public Comments: Empowering the People or Testing the Waters?

Simultaneously, the SEC has opened a revolutionary chapter by allowing public comments on spot Bitcoin ETF filings. This move is unprecedented in its transparency, providing an opportunity for stakeholders, industry experts, and the general public to actively participate in the regulatory decision-making process.

The significance of public comments cannot be overstated. It represents a democratic approach to regulation, allowing the crypto community to voice opinions on whether these investment products align with anti-manipulation and investor protection requirements. Is this a genuine effort by the SEC to engage with the public, or could it be a strategic tool to gauge market sentiment before making critical decisions?Discover more: US Deputy Secretary Urges Crypto Industry to Curb Terrorist Financing

Bloomberg Analyst’s Bold Prediction: January Revolution?

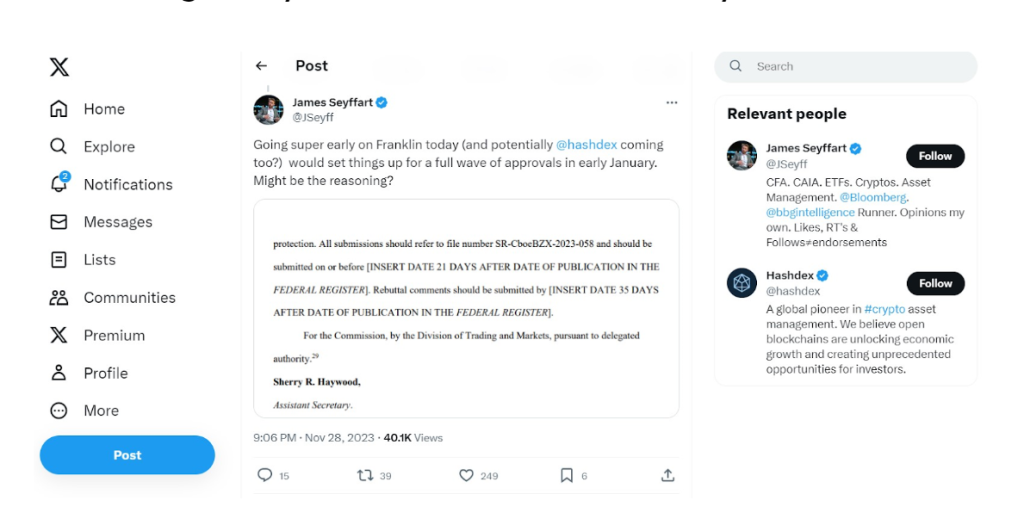

Adding to the unfolding drama, Bloomberg ETF analyst James Seyffart injects a dose of anticipation into the narrative. Seyffart believes that the SEC’s recent actions, particularly the postponement of decisions and the initiation of public comments, might be setting the stage for a groundbreaking wave of spot Bitcoin ETF approvals come January.

This prediction introduces an exciting element to the regulatory discourse, raising the stakes for a potential revolution in the crypto investment landscape. Could January 2023 be the month that spot Bitcoin ETFs receive the green light, transforming the dynamics of crypto investments? The industry watches with bated breath as Seyffart’s insights spark both hope and speculation.

A Regulatory Landscape in Flux

The SEC’s recent moves, particularly the collection of public comments on spot Bitcoin ETFs, have thrown the regulatory landscape into flux. As the crypto community actively engages in shaping the destiny of these investment products, the industry grapples with a multitude of questions. Is this a paradigm shift in regulatory transparency, or is it a calculated move by the SEC to gather insights before making pivotal decisions?

As January approaches, the crypto space stands at the precipice of transformation. The SEC’s willingness to listen to public voices adds an empowering dimension to the regulatory process, making it a shared endeavor between regulators and the crypto community. The fate of spot Bitcoin ETFs now rests not only in regulatory chambers but also in the hands of those passionate about the future of crypto investments.