Table of Contents,

The Future of Ethereum Staking: Vitalik Buterin’s Vision for UTXO Model Integration

The landscape of Ethereum is poised for a transformation as Vitalik Buterin, the co-founder of Ethereum, unveils his vision for redefining staking through the introduction of the UTXO (Unspent Transaction Output) model.

At the Devconnect 2023 conference in Istanbul, Buterin shed light on Ethereum’s future development plans, expressing concerns about the concentration of ETH in liquid staking services and proposing an alternative approach.

You can watch the full interview here!

Challenging Staking Concentration

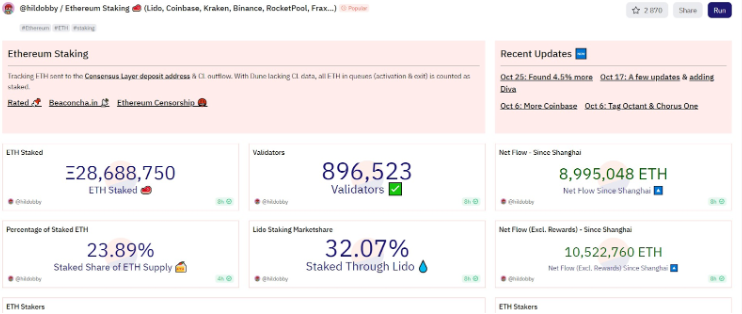

One of Buterin’s primary concerns is the centralization of ETH within liquid staking services. Currently, Lido holds 32% of the ETH staked, with the top three providers—Lido, Coinbase, and Figment—controlling 50.9% of the total ETH staked.

This concentration raises questions about the decentralization and security of the Ethereum network, prompting Buterin to seek innovative solutions.

You might also like: Keith Grossman’s Opinion on User Experience in Blockchain

The UTXO Model’s Potential

Buterin’s proposal introduces the UTXO transaction model, a paradigm shift from Ethereum’s conventional balance model. In the UTXO model, tokens exist as unused outputs, requiring the owner’s signature for specific UTXOs to be spent. This setup presents a novel way to alter the ownership of tokens within smart contracts without necessitating user consent, providing a more dynamic and flexible approach to managing assets on the Ethereum blockchain.

Positive Impacts of UTXO Integration

- Enhanced Decentralization: The UTXO model could mitigate the concentration of staked ETH in a few large services, fostering greater decentralization. That aligns with Ethereum’s core principles of democratizing access to financial services and ensuring a more resilient network.

- Improved Security: By reducing the dominance of a few staking providers, the Ethereum network becomes less susceptible to attacks or collusion among major players. The UTXO model’s enhanced security features can bolster the overall resilience of the ecosystem.

- Flexible Asset Management: With the UTXO model, smart contract administrators can adjust token ownership without user consent. This flexibility can lead to a substantially more efficient and responsive management of assets, opening up new possibilities for decentralized applications and financial instruments.

Potential Drawbacks and Concerns

- Technical Challenges: Integrating the UTXO model into Ethereum would necessitate significant technical modifications, potentially leading to challenges and complexities in the implementation process. That could result in disruptions and require extensive testing to ensure a smooth transition.

- Community Adoption: Any major change in the Ethereum protocol is contingent on widespread community support. Convincing the diverse Ethereum community to embrace the UTXO model might prove challenging, as stakeholders may have differing opinions on the necessity and feasibility of such a fundamental shift.

- Learning Curve: Developers, users, and stakers accustomed to the current balance model would need to adapt to the intricacies of the UTXO model. This learning curve could slow adoption and lead to resistance within the Ethereum ecosystem.

Final Words

Vitalik Buterin’s proposal to introduce the UTXO model to Ethereum staking signifies a bold step toward addressing concentration issues and enhancing the overall functionality of the network. While the potential benefits are promising, carefully considering the associated challenges is crucial for a successful implementation that aligns with Ethereum’s ethos of decentralization and innovation. As the Ethereum community engages in discussions surrounding this proposed shift, the path forward will undoubtedly shape the future of decentralized finance on the Ethereum blockchain.