The world of cryptocurrencies and digital assets has witnessed a groundbreaking development as Standard & Poor’s, a renowned rating agency, evaluated stablecoins for the first time. In this assessment, several critical factors were scrutinized to provide a comprehensive understanding of the stability and reliability of these digital currencies.

Table of Contents,

Assessing Stability: The Rating Breakdown

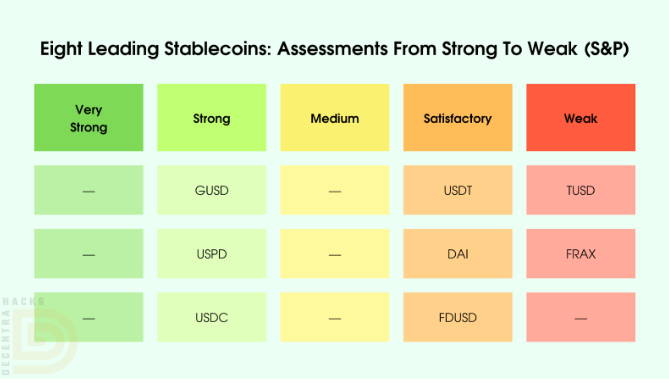

Standard & Poor’s classified stablecoins into distinct reliability categories based on meticulous evaluations. The parameters considered included risks, collateral requirements, liquidation mechanisms, regulatory compliance, dependence on third-party entities, and a retrospective analysis of past incidents. The reliability estimates were categorized as follows:

- Very Strong: No Stablecoin

- Strong: GUSD, USDP, USDC

- Medium: No Stablecoin

- Satisfactory: USDT, DAI, FDUSD

- Weak: TUSD, FRAX

Transparency Triumphs: The High Performers

Unveiling the results, it’s evident that transparency emerged as a pivotal factor influencing the ratings. Stablecoins such as USDC, GUSD, and USDP were lauded for their high marks in transparency. The openness and accessibility of information about these stablecoins played a crucial role in establishing their credibility in Standard & Poor’s eyes.

Behind the Curtain: Low Ratings for USDT and FDUSD

On the flip side, USDT and FDUSD found themselves on the lower end of the spectrum. The primary reasons behind their less favorable ratings were the need for more transparency and the absence of publicly available counterparty data. In a world increasingly valuing openness and accountability, these stablecoins faced the consequences of insufficient disclosure.

Learn more! Discover how Tether Is Blocking Wallets from OFAC Blacklist.

No Perfect Score: The Pervasiveness of Peg Loss

Despite the efforts to evaluate and categorize stablecoins, not a single digital currency received the highest rating. This revelation underscores a pervasive issue within the stablecoin ecosystem – the inability to maintain a consistent peg to the U.S. Dollar. At some point, each stablecoin experienced fluctuations that compromised its peg, emphasizing the inherent challenges in achieving absolute stability.

Looking Beyond the Ratings: Implications and Considerations

The S&P ratings highlight the complex nature of stablecoins, shedding light on their strengths and vulnerabilities. Investors, regulators, and the crypto community now have a valuable resource to make more rational and informed decisions regarding their engagement with these digital assets.

As the cryptocurrency landscape continues to evolve, rating stablecoins by esteemed entities like Standard & Poor’s marks a significant milestone. This development prompts a crucial dialogue within the industry about enhancing transparency, mitigating risks, and fortifying regulatory compliance. Stablecoin issuers may find impetus to bolster their practices and provide a more robust framework for their digital currencies.

Regulatory Frameworks: A Key Player in Stability

One of the critical factors influencing these ratings was regulatory compliance. As governments worldwide grapple with regulating digital currencies, stablecoins that align with evolving legal frameworks are likely to gain favor among investors and users. The symbiotic relationship between regulatory clarity and stablecoin reliability cannot be overstated, pointing towards the need for ongoing collaboration between the crypto industry and regulators.

The Transparency Dilemma: Balancing Privacy and Disclosure

The discrepancy in ratings due to transparency issues raises questions about striking the optimal balance between user privacy and the need for disclosure. As stablecoin projects navigate this delicate terrain, finding solutions that satisfy both regulatory demands and user expectations becomes imperative for long-term success.

A New Era of Stablecoin Evaluation

Standard & Poor’s inaugural ratings of stablecoins mark a pivotal moment in the cryptocurrency space. While the results provide valuable insights into the strengths and weaknesses of various stablecoins, the industry must now collectively work towards refining these digital assets. As the ecosystem matures, the quest for a stable, transparent, and regulatory-compliant stablecoin continues, driving innovation and improvements that will shape the future of digital finance.