Since its inception, Bitcoin (BTC) has been a topic of fascination, speculation, and fervent predictions. The latest buzz in the cryptocurrency world revolves around Tom Lee’s audacious prediction of a Bitcoin price surge to $150,000 to $180,000, driven by the approval of a spot ETF. While optimism is a driving force in the crypto space, it’s crucial to scrutinize such lofty predictions in the context of the complex and ever-evolving cryptocurrency market.

Table of Contents,

The Tom Lee Prediction: A Bold Proclamation

Fundstrat’s co-founder, Tom Lee, recently made headlines with his prediction that Bitcoin’s price could skyrocket if a spot ETF is approved. Lee’s forecast starkly contrasts with more conservative estimates from other market experts. In his interview with CNBC, he confidently asserted that nothing could halt Bitcoin’s ascent, especially when combining the narratives of a spot ETF and Bitcoin halving.

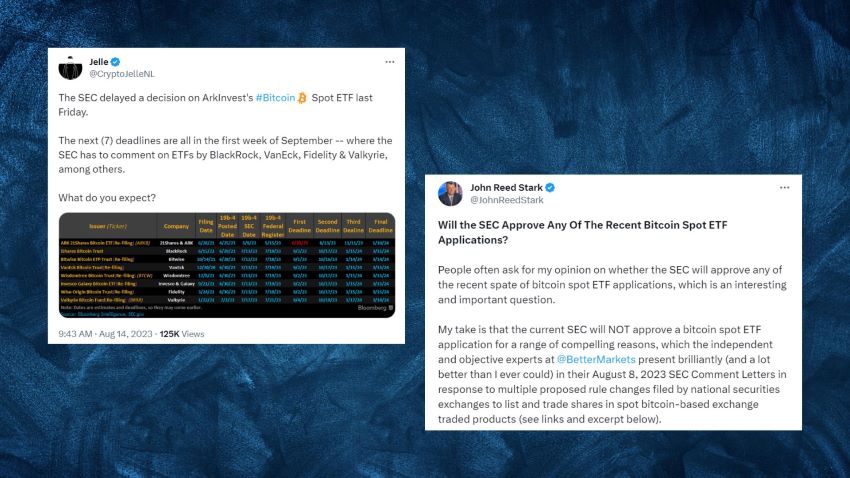

The SEC’s Delays and the European Advantage

The approval of a spot ETF in the United States has been an elusive goal, marked by a series of delays. Recent events, such as the SEC’s postponement of decisions on Cathie Wood’s Ark Invest proposal and Grayscale’s appeal for a Bitcoin Trust conversion to an ETF, have further complicated the regulatory landscape. That has allowed Europe to take the lead with the successful launch of a spot BTC ETF, BCOIN, on Euronext Amsterdam, courtesy of Jacobi Asset Management.

Europe’s commitment to pushing forward despite challenges has been commendable. In contrast, the United States has been stuck in a waiting game, with industry giants like BlackRock and Fidelity awaiting a determination in September.

The Historical Context of Bitcoin Halvings

It’s essential to consider Bitcoin’s historical price behavior in the context of halving events. Over the past three halving cycles, Bitcoin’s price has consistently reached new record highs within 12 months. This historical precedent supports the notion that Bitcoin’s price could experience significant gains in the future.

However, Tom Lee’s lofty $180,000 per Bitcoin prediction raises valid questions. While historical trends indicate the potential for substantial price increases, it is essential to remember that past performance does not guarantee future results.

The Role of Other Influencing Factors

Tom Lee acknowledges that various factors are in play, influencing Bitcoin’s price dynamics. These include “easing macro conditions and Fed policy.” While a spot ETF approval could inject optimism into the market, it is just one piece of the puzzle. External economic and policy factors can significantly influence Bitcoin’s price trajectory.

Assessing Feasibility

Predicting Bitcoin’s price with precision is notoriously challenging due to its inherent volatility and sensitivity to market sentiment. While a spot ETF approval could be a positive catalyst, it may not be the sole determinant of whether Bitcoin reaches the ambitious $150,000 to $180,000 range.

In conclusion, while Tom Lee’s prediction of a Bitcoin price surge via a spot ETF approval is intriguing, it should be taken cautiously. The cryptos market is complex and influenced by numerous variables. Investors and enthusiasts should remain vigilant, considering a comprehensive range of factors when evaluating Bitcoin’s future price movements. Whether or not Bitcoin reaches the predicted heights, its journey will undoubtedly continue to be a captivating one in the world of finance.