In the ever-evolving world of cryptocurrency, change is the only constant. Mike Belshe, the CEO of BitGo, a prominent crypto custodian, has raised an intriguing notion. He believes that while digital assets are here to stay, Bitcoin (BTC) may not forever retain its crown as the premier cryptocurrency. This thought-provoking perspective warrants a closer look.

You might also be interested: $150K-$180K Bitcoin Price Prediction

Table of Contents,

Digital Assets’ Permanence

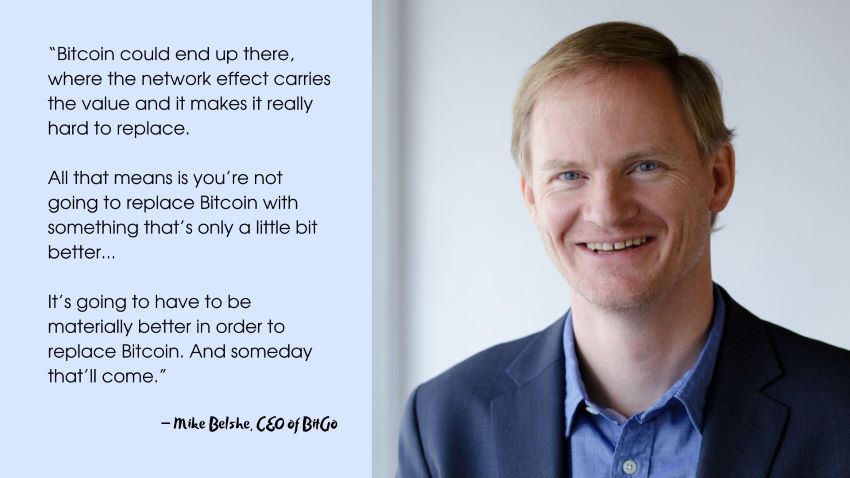

Mike Belshe acknowledges the enduring significance of digital assets in the financial landscape. In an interview with Kitco News, he affirms that cryptocurrencies are undeniably “here to stay.” This stance underscores the transformative power of blockchain technology and decentralized digital currencies. However, Belshe ventures into uncharted territory when he suggests that Bitcoin’s reign may be temporary.

Bitcoin as the Amazon of Cryptocurrency

To elucidate his point, Belshe draws an interesting parallel between Bitcoin and Amazon. He likens Bitcoin to the e-commerce giant, explaining that while it might be possible to create a “much better” version of Amazon, the sheer size and network effect of the current leader makes dethroning it a formidable challenge. Similarly, in the cryptocurrency realm, supplanting Bitcoin would not be a straightforward task.

The Potential for Improvement

Belshe’s assertion that something “materially better” than Bitcoin could emerge raises intriguing questions. The cryptocurrency community has witnessed innovations and advancements continually pushing the boundaries of what digital assets can achieve. As technology evolves, it is not implausible to envision the emergence of a cryptocurrency that addresses some of Bitcoin’s limitations, such as scalability or energy consumption.

Implications for the Crypto Market

If Belshe’s prediction were to materialize, what would it mean for the broader cryptocurrency market? A shift in the dominant cryptocurrency could impact investment strategies, market dynamics, and the overall perception of digital assets. Investors and enthusiasts would need to adapt to a changing landscape, potentially diversifying their portfolios and exploring new opportunities.

Conclusion

Mike Belshe’s perspective serves as a reminder that innovation and competition are integral to the cryptocurrency ecosystem. While Bitcoin’s dominance is unquestionable today, the future remains uncertain. Whether a superior digital asset emerges or Bitcoin continues to evolve, the crypto world is in a constant state of flux. The only certainty is that the journey of digital currencies is far from over, and the best may be yet to come.