In a significant move echoing the evolving regulatory landscape of the cryptocurrency industry, Bitstamp, a prominent global crypto exchange, has announced the discontinuation of its staking service in the United States. This decision, effective from September 25, stems from regulatory complexities that have prompted the platform to recalibrate its offerings. As the crypto community grapples with this change, let’s delve into the implications and reasons behind Bitstamp’s withdrawal from the U.S. crypto market.

Table of Contents,

Regulatory Hurdles and Decision Ramifications

Bitstamp has been a stalwart in the crypto space, renowned for its user-friendly interface and diverse offerings. However, the discontinuation of its staking services within the United States hints at the formidable challenges posed by the evolving regulatory environment. The cryptocurrency sector has witnessed a flurry of regulatory developments, underscoring the need for exchanges to align their operations with ever-changing compliance standards.

The Commission Structure and Reward Rates

Bitstamp’s staking service was notable for its 15% commission on all staking rewards, a model that aimed to balance profitability with user incentives. This commission structure, while ensuring the exchange’s sustainability, also attracted criticism for its relatively high rate. In contrast, the monthly reward rate for Ether (ETH) on Bitstamp was an enticing 4.50%. However, juxtaposing this with the monthly reward for Algorand (ALGO) at 1.60% sheds light on the varying dynamics of the crypto market across different cryptocurrencies.

Global Impact on Staking Services

With the cessation of U.S. staking services, the United States now joins other countries where Bitstamp’s staking offerings are not available, including Canada, Japan, Singapore, and the United Kingdom. This geographical limitation reflects the intricate web of regulations that dictate the crypto landscape in various jurisdictions. As the industry matures, exchanges are compelled to navigate these legal intricacies to ensure compliance while continuing to cater to a global user base.

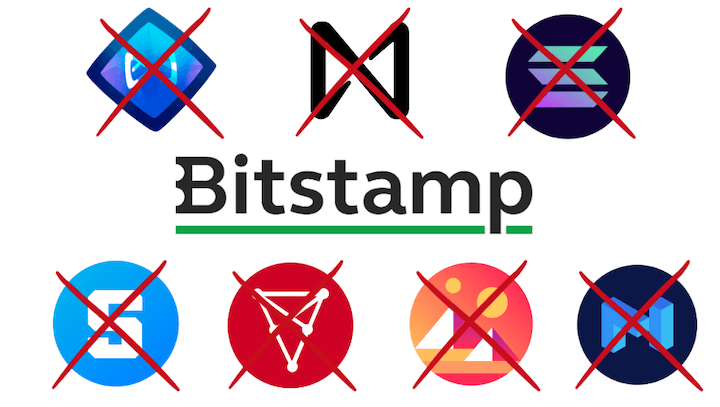

Legal Developments and Altcoin Exclusion

Bitstamp’s decision appears to be intertwined with recent legal developments in the United States. In a notable prelude to this announcement, the exchange declared that several altcoins, including AXS, CHZ, MANA, MATIC, NEAR, SAND, and SOL, would no longer be offered within the country. This maneuver further highlights Bitstamp’s commitment to aligning its offerings with regulatory prerequisites and streamlining its operations to avoid potential legal entanglements.

Implications for Crypto Enthusiasts

For the crypto enthusiasts who have relied on Bitstamp’s staking service, this decision serves as a poignant reminder of the industry’s dynamic nature. As regulations evolve and impact the way exchanges function, users are encouraged to stay vigilant, adapt to changing circumstances, and explore alternative staking options available in the market. This incident underscores the importance of understanding the regulatory underpinnings of the crypto space and equipping oneself with knowledge that empowers informed decisions.

Conclusion

Bitstamp’s discontinuation of its U.S. staking service, prompted by regulatory hurdles and legal developments, reflects the industry’s ongoing transformation. As the United States joins other nations in the list of countries where Bitstamp’s staking services are no longer available, crypto enthusiasts must remain attuned to the shifting regulatory landscape. While this decision underscores the challenges that exchanges face, it also emphasizes the importance of compliance and adaptability in a sector that continues to redefine the global financial landscape. As the crypto community navigates these changes, staying informed remains a potent tool for maximizing opportunities while mitigating risks. Learn more about new events: Empowering Privacy: Elusiv Introduces ‘Private Token Swaps’ on Solana.