The cryptos market is renowned for its volatility, and it showcased this trait once again as Bitcoin (BTC) experienced an overnight surge to $35,000 ($34,434.87 now). At the same time, Ethereum (ETH) saw its price soar to $1,800 ($1,828.51 now). While rapid price fluctuations are common in the crypto world, this particular spike raised eyebrows, with a possible connection to BlackRock and the anticipation of a spot Bitcoin ETF.

You might also like: BitVM: Transforming Bitcoin’s Smart Contracts

Table of Contents,

The BlackRock Factor

One of the leading speculations behind this sudden price increase is the involvement of BlackRock. The asset management giant has been making waves in the crypto space. Despite the prevailing silence from the US Securities and Exchange Commission (SEC) regarding cryptocurrency exchange-traded funds (ETFs), BlackRock is seemingly gearing up to launch a spot Bitcoin ETF.

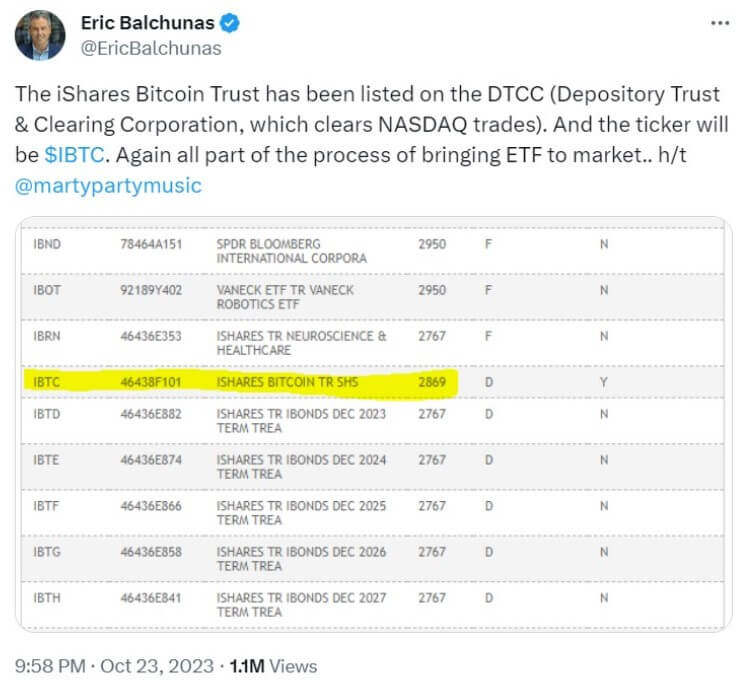

An intriguing development that fueled the fire of speculation occurred when the iShares Bitcoin Trust ETF appeared on the Depository Trust & Clearing Corporation (DTCC) lists at 10:00 p.m. This corporation plays a pivotal role in clearing transactions on the NASDAQ exchange.

While this event piqued the interest of the crypto community, it’s crucial to note that the appearance of a fund on the DTCC’s lists is not an explicit signal that the SEC has already granted approval or will do so in the immediate future. It’s worth emphasizing that the cryptocurrency ETF landscape in the United States has been a subject of considerable speculation and anticipation for quite some time.

Eric Balhunas’ Insights

Eric Balhunas, a specialist in Exchange-Traded Funds (ETFs) at Bloomberg, weighed in on the situation. He noted that companies frequently register funds with clearing institutions like the DTCC shortly before launching them. This common practice only sometimes signifies that regulatory approval is imminent. It is, however, an indication of preparations and potential forward movement in the ETF space.

The SEC and Crypto ETFs

The US SEC has been at the center of the cryptocurrency ETF saga for some time. Market participants and enthusiasts have been eagerly awaiting regulatory clarity and the eventual approval of these funds. A cryptocurrency ETF, particularly a spot Bitcoin ETF, holds significant potential for legitimizing the asset class and making it more accessible to mainstream investors.

The SEC’s cautious approach reflects the complexities and regulatory challenges surrounding cryptocurrencies. While the wait for regulatory clarity has been prolonged, it’s important to recognize that the process is characterized by careful evaluation and consideration of crypto ETFs’ implications, risks, and benefits.

Conclusion: Cryptocurrency’s Ongoing Evolution

The overnight surge of Bitcoin to $35,000 and Ethereum to $1,800 underscores the cryptocurrency market’s dynamism and unpredictability. While speculation surrounds the influence of BlackRock and the potential launch of a much-needed spot Bitcoin ETF, it is a testament to the crypto industry’s continuous evolution.

As the SEC continues its evaluation of cryptocurrency ETFs, investors, and enthusiasts eagerly await regulatory clarity that could usher in a new era for digital asset investment. While no immediate approval may be guaranteed, the anticipation surrounding the ETF landscape highlights the growing interest and recognition of cryptocurrencies in traditional financial markets. The journey towards legitimizing these assets as mainstream investment options continues.