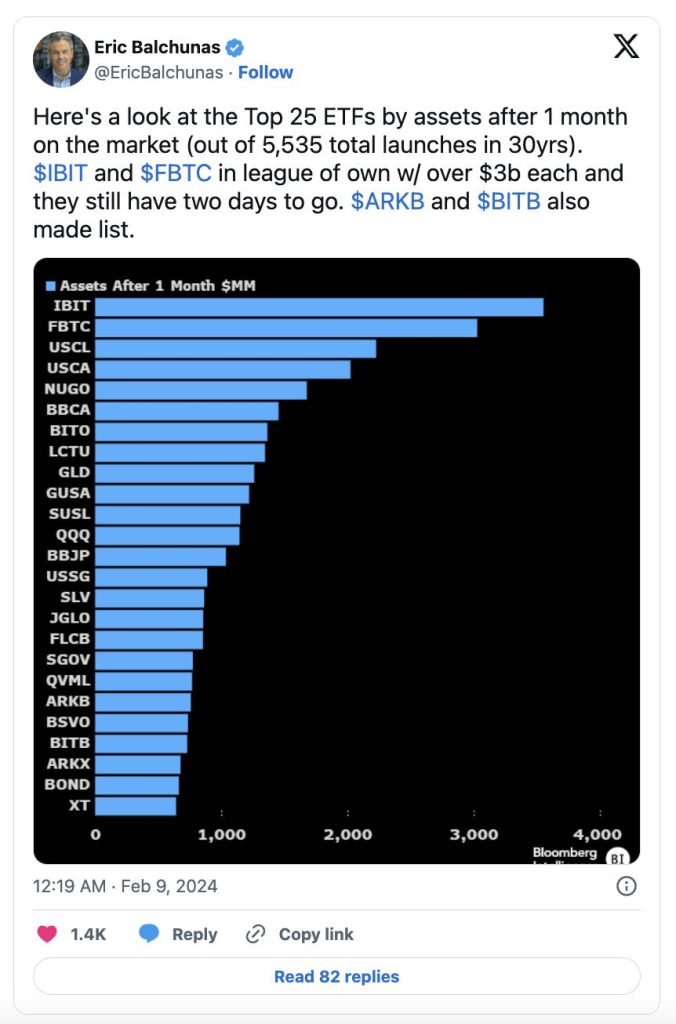

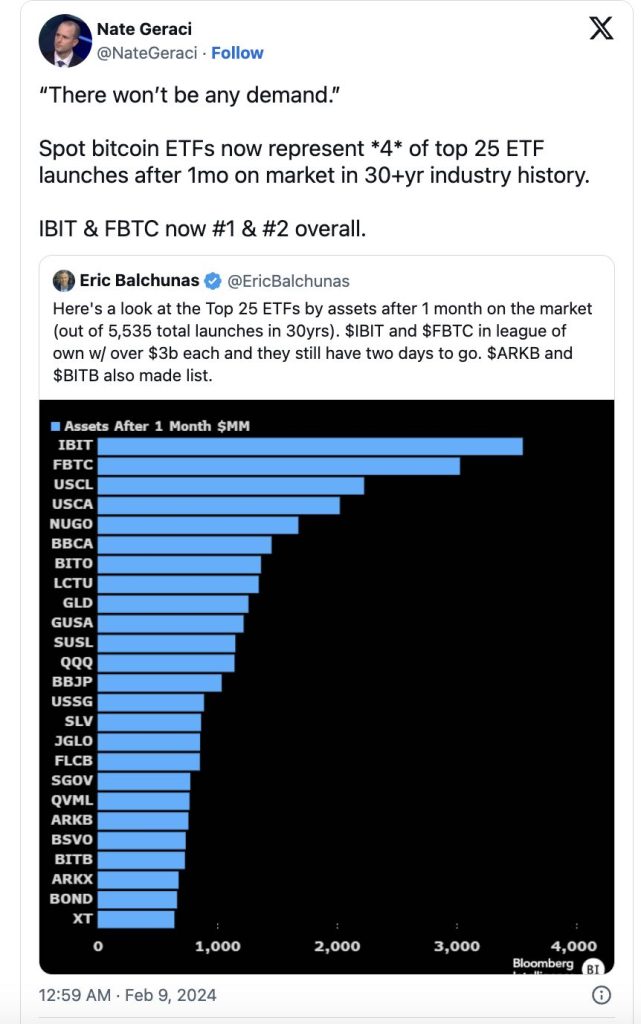

The cryptocurrency landscape has witnessed a monumental milestone as the Bitcoin Exchange-Traded Funds (ETFs) launched by financial behemoths BlackRock and Fidelity achieved the largest debut month of any ETF in the last 30 years. This historic achievement not only underscores the burgeoning interest in digital currencies among traditional investors but also signals a potential paradigm shift in the perception and integration of cryptocurrency within mainstream financial markets. As we delve into this remarkable development, decentrahacks.com explores the implications of this success for the future of cryptocurrency and the broader financial ecosystem.

Table of Contents,

The Significance of BlackRock and Fidelity’s Entry

The entry of BlackRock and Fidelity into the cryptocurrency space via their Bitcoin ETFs is a testament to the growing legitimacy and acceptance of digital currencies in the financial world. These firms, with their vast resources and influence, bring a level of credibility and stability to the volatile cryptocurrency market, potentially attracting a new wave of institutional and retail investors who were previously hesitant.

Argument 1: A Milestone for Cryptocurrency Adoption

The success of these Bitcoin ETFs represents a significant milestone for cryptocurrency adoption. It demonstrates a robust demand for digital currencies among a wider audience, validating the argument that cryptocurrencies are becoming an indispensable part of the global financial landscape. Furthermore, the ETFs simplify the process of investing in Bitcoin, offering investors exposure to its price movements without the complexities of direct ownership and storage.

Argument 2: The Potential for Market Stability

One of the critical arguments in favor of the widespread adoption of Bitcoin ETFs is their potential to bring stability to the cryptocurrency market. By providing a regulated, transparent, and accessible avenue for Bitcoin investment, these ETFs could mitigate some of the market’s volatility, making digital currencies a more attractive option for long-term investment strategies.

Counterargument: Concerns Over Market Impact

However, skeptics argue that the rapid influx of capital into Bitcoin via these ETFs could exacerbate market volatility and lead to increased speculation. There are concerns that the concentration of Bitcoin ownership within large, institutional ETFs could undermine the decentralized ethos of cryptocurrency, potentially making the market more susceptible to manipulation.

The Broader Implications for Financial Markets

The unprecedented success of BlackRock and Fidelity’s Bitcoin ETFs also raises questions about the future of financial markets. As digital currencies become more integrated into traditional investment portfolios, financial institutions may need to adapt their strategies and infrastructure to accommodate these new assets. This shift could pave the way for further innovations in blockchain technology and digital finance, reshaping the financial landscape in ways yet to be fully understood.

Conclusion

The record-setting debut of BlackRock and Fidelity’s Bitcoin ETFs is a watershed moment for the cryptocurrency industry, marking a significant step toward mainstream acceptance and adoption. While the long-term implications of this development are still unfolding, it is clear that the landscape of financial investment is evolving, with digital currencies playing an increasingly central role. As the debate over the benefits and risks of cryptocurrency ETFs continues, one thing is certain: the intersection of traditional finance and digital assets will remain a hotbed of innovation and discussion for years to come.