In the ever-fluctuating world of cryptocurrency, Ethereum’s recent journey to the $3,000 resistance mark has been a topic of keen interest and speculation. While encountering resistance at such a pivotal price point might suggest a momentary pause in its ascent, current market data and underlying fundamentals present a compelling case for a bullish outlook on Ethereum (ETH). This article for decentrahacks.com delves into the dynamics at play, exploring why, despite the immediate hurdle, the broader perspective seems to favor ETH bulls.

Table of Contents,

Understanding the $3K Resistance

The $3,000 price level for Ethereum is more than just a numerical milestone; it represents a psychological barrier for investors and a technical resistance point on the charts. Historically, such levels have been critical in determining the asset’s short-term price movements, acting as a pivot between further rallies or potential retracements. Ethereum’s approach to this threshold has ignited debates among traders and analysts, with opinions divided on the immediate future.

Data Favors Ethereum Bulls

Despite the resistance faced at $3,000, several indicators and market trends underscore a favorable outlook for Ethereum:

- Decentralized Finance (DeFi) and NFT Growth: Ethereum remains the backbone of the burgeoning DeFi sector and the exploding market for Non-Fungible Tokens (NFTs). The continuous growth in these areas not only showcases Ethereum’s utility but also increases the demand for ETH, potentially exerting upward pressure on its price.

- Ethereum 2.0 Anticipation: The ongoing transition to Ethereum 2.0, with its promise of scalability, sustainability, and enhanced security through the shift to Proof of Stake (PoS), has been a significant bullish driver. Investors are optimistic about the network’s future, and this sentiment could propel ETH beyond current resistance levels.

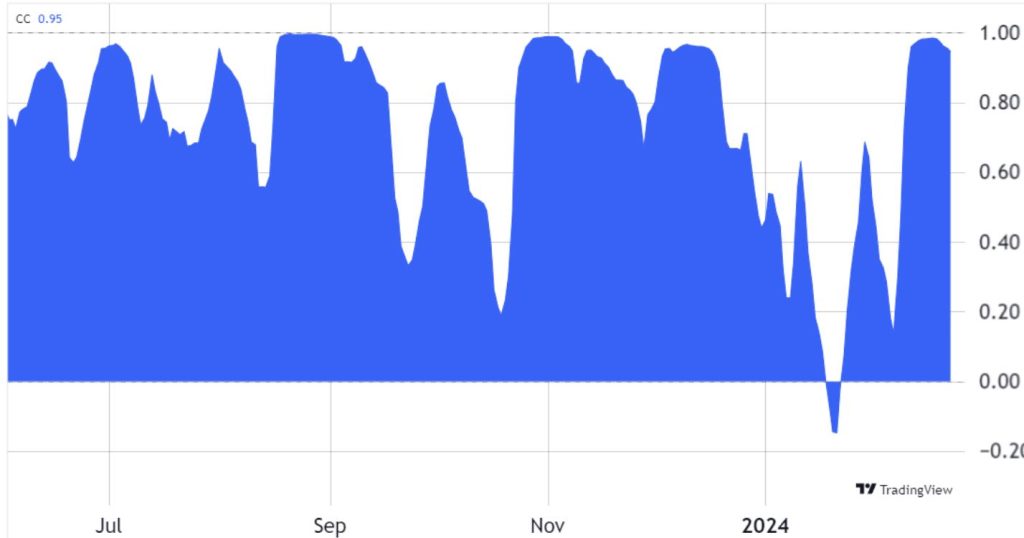

- Institutional Interest: The growing interest from institutional investors in Ethereum as a viable investment option adds another layer of support for its price. As institutions seek to diversify their portfolios beyond Bitcoin, Ethereum stands out as a compelling choice, given its utility and the innovative projects it hosts.

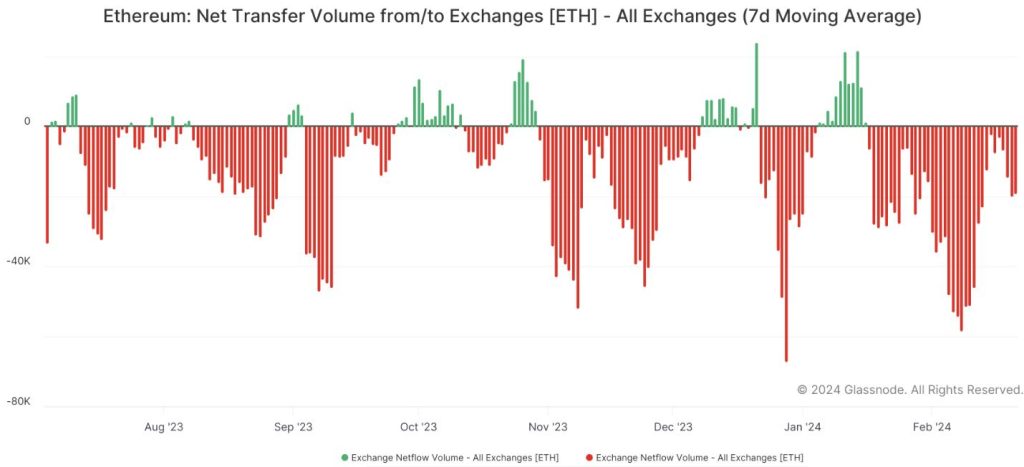

- Technical Indicators: Several technical analysis metrics and indicators, such as moving averages and relative strength indices, point towards a bullish trend for Ethereum in the medium to long term. Furthermore, the increasing transaction volumes and active addresses on the Ethereum network underscore the growing usage and adoption of ETH.

The Path Forward: Overcoming Resistance

While the $3,000 resistance level is a notable challenge, the underlying strength of Ethereum, coupled with favorable market trends, suggests that ETH bulls have the upper hand in the longer term. However, investors should remain vigilant, as cryptocurrency markets are notoriously volatile, and external factors such as regulatory developments or macroeconomic trends could impact price movements.

Conclusion

Ethereum’s encounter with the $3,000 resistance mark is a crucial juncture in its market trajectory. However, when considering the confluence of DeFi and NFT expansion, the Ethereum 2.0 upgrade, increasing institutional interest, and supportive technical indicators, the outlook for Ethereum is predominantly bullish. While short-term fluctuations are inevitable, the fundamental and market-driven factors currently favor ETH bulls, painting a promising picture for Ethereum’s journey ahead. As always, investors are advised to conduct their own research, consider market risks, and adopt a measured approach to their investment strategies.