The cryptocurrency industry is on the cusp of another significant milestone: the upcoming Bitcoin halving event. Historically, halving has been a momentous occasion that has not only affected Bitcoin’s price but also had profound implications for miners. As rewards for mining Bitcoin are set to halve, concerns are mounting over the potential impact on the mining landscape, especially within the United States. Critics argue that this could lead to a “blood bath” for US-based miners, possibly pushing them offshore in search of more favorable economic conditions. This article for decentrahacks.com explores the arguments surrounding the potential exodus of US miners due to the upcoming halving event and its broader implications for the global cryptocurrency market.

Table of Contents,

Understanding the Bitcoin Halving

Bitcoin halving is an event programmed into Bitcoin’s code that reduces the reward for mining new blocks by 50%. This event occurs approximately every four years and is designed to control inflation by gradually decreasing the supply of new bitcoins entering the market. While halving can potentially increase Bitcoin’s value by making it scarcer, it also significantly impacts miners’ profitability by reducing their rewards.

The Economic Challenge for US Miners

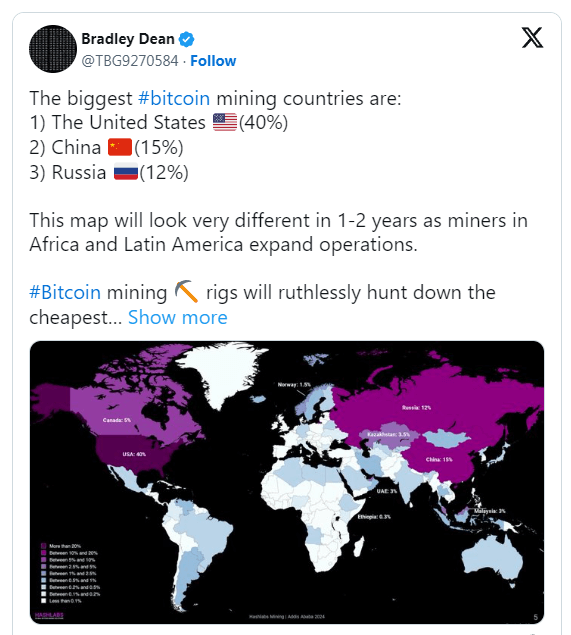

The primary concern with the upcoming halving is its economic impact on miners, particularly those operating in the United States. High operational costs, including electricity and cooling expenses, coupled with the reduced block rewards, could severely diminish profit margins for US miners. This economic squeeze may force miners to reassess the viability of continuing operations within the US, where energy costs can be prohibitive compared to other countries with cheaper, more abundant power sources.

Arguments for a Potential Exodus

- Increased Operational Costs: As the reward for mining decreases, the importance of operational efficiency becomes paramount. Miners in the US, facing higher electricity rates and regulatory burdens, may find it increasingly difficult to compete with international miners who enjoy lower costs.

- Regulatory Environment: The regulatory landscape in the US, which is often seen as uncertain or unfriendly towards cryptocurrency, may further discourage miners from maintaining their operations stateside post-halving.

- Global Competition: The global nature of Bitcoin mining means that miners are always in competition with one another, regardless of geographic location. Post-halving, the competition will intensify, possibly favoring miners in regions with lower operational costs.

Counterarguments: Staying Power of US Miners

Despite these challenges, there are several reasons why US miners might weather the halving storm:

- Technological Advancements: Continuous improvements in mining technology and efficiency could help offset the reduced rewards, making it possible for US miners to remain competitive.

- Diversification and Innovation: Many US mining operations are diversifying their revenue streams and exploring innovative solutions, such as using excess heat for other purposes, which could mitigate the impact of halving.

- Institutional Support: The growing institutional interest in Bitcoin and cryptocurrency in the US could lead to increased support for miners, including potential subsidies or partnerships that lower operational costs.

Conclusion

The upcoming Bitcoin halving undoubtedly presents a significant challenge for US miners, potentially exacerbating the economic pressures they face. While the possibility of an exodus exists, it is crucial to consider the resilience and adaptability of the US mining sector. The interplay of technological advancements, regulatory changes, and global market dynamics will ultimately determine the future landscape of Bitcoin mining in the US and worldwide. As the halving event approaches, the cryptocurrency community will be watching closely to see how these factors unfold, shaping the direction of Bitcoin mining for years to come.