In a remarkable display of market dynamics, Worldcoin has seen its value soar by 140% in just one week, coinciding with the wallet app reaching an impressive milestone of 1 million daily users. This surge has sparked a debate among cryptocurrency enthusiasts, investors, and skeptics alike. Is Worldcoin’s rapid ascent a sign of its long-term viability and adoption, or is it merely the latest speculative bubble in the volatile world of cryptocurrency? This article for decentrahacks.com delves into the arguments on both sides, examining the factors behind Worldcoin’s rise and the broader implications for the cryptocurrency market.

Table of Contents,

The Case for Sustainability

Proponents of Worldcoin argue that the recent surge in its value is not only sustainable but indicative of the cryptocurrency’s potential for widespread adoption. Key arguments include:

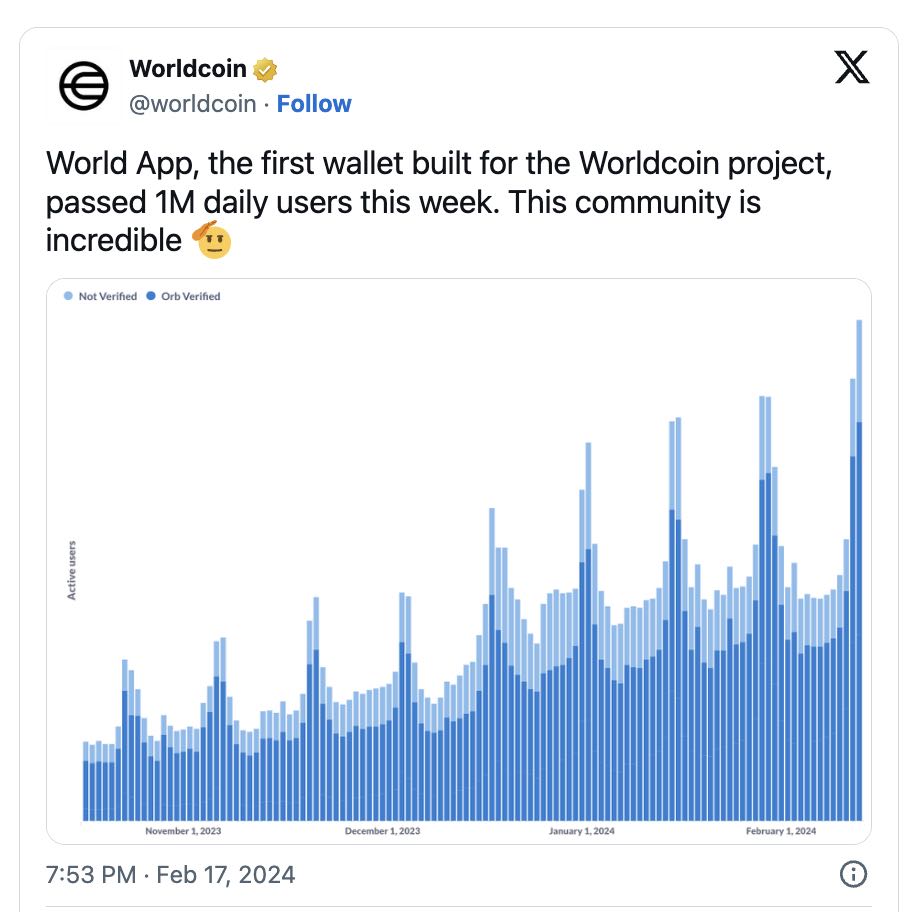

- User Adoption: The milestone of achieving 1 million daily users for the wallet app is seen as a clear indicator of Worldcoin’s growing acceptance and utility. This level of user engagement suggests a strong foundation for future growth, beyond mere speculation.

- Innovative Features: Worldcoin’s unique features, such as enhanced privacy measures, fast transaction speeds, and user-friendly interface, are cited as reasons for its rapid adoption. Advocates believe these innovations address many of the pain points associated with older cryptocurrencies, making Worldcoin a more attractive option for both new and seasoned crypto users.

- Market Diversification: The argument for sustainability is further bolstered by Worldcoin’s efforts to diversify its market presence and utility. By targeting various sectors and integrating with different technologies, Worldcoin is positioning itself as a versatile asset in the crypto ecosystem.

The Case for Speculation

On the flip side, critics argue that Worldcoin’s explosive growth is emblematic of a speculative bubble, highlighting several concerns:

- Market Volatility: Critics point to the inherent volatility of the cryptocurrency market, where rapid surges in value are often followed by equally swift corrections. They caution that Worldcoin’s current valuation may not be grounded in its actual utility or adoption but rather in speculative trading.

- Sustainability of User Growth: While the achievement of 1 million daily users is noteworthy, skeptics question the sustainability of this growth. They argue that initial spikes in user adoption can be fleeting, driven by curiosity or the allure of quick gains, rather than long-term commitment to the platform.

- Historical Precedents: The cryptocurrency market has witnessed numerous instances of tokens experiencing meteoric rises, only to see their values plummet once the speculative fervor subsides. Critics of Worldcoin’s recent performance draw parallels to these past bubbles, suggesting that a correction may be imminent.

Conclusion

Worldcoin’s remarkable week of growth has undoubtedly placed it at the center of attention within the cryptocurrency community. The debate over whether this surge is a harbinger of sustainable growth or a speculative bubble mirrors broader discussions about the nature of value and adoption in the crypto market. As Worldcoin navigates this pivotal moment, its ability to maintain user engagement, innovate, and diversify its utility will be critical in determining its long-term position in the cryptocurrency landscape. Regardless of the outcome, Worldcoin’s current trajectory serves as a case study in the complex interplay of technology, market dynamics, and user behavior that defines the ever-evolving world of cryptocurrency.