In the ever-evolving world of finance and cryptocurrency, innovation often blurs the lines between regulation and progress. An intriguing concept has emerged, suggesting that Grayscale, a prominent player in the digital asset space, might list its GBTC (Grayscale Bitcoin Trust) as an Exchange-Traded Fund (ETF) on the New York Stock Exchange (NYSE), bypassing the need for approval from the US SEC. But how feasible is this idea, and what are the potential implications? Let’s dive into the details.

You might be interested: David Marcus Envisions Bitcoin as a Global Payment Network

Table of Contents,

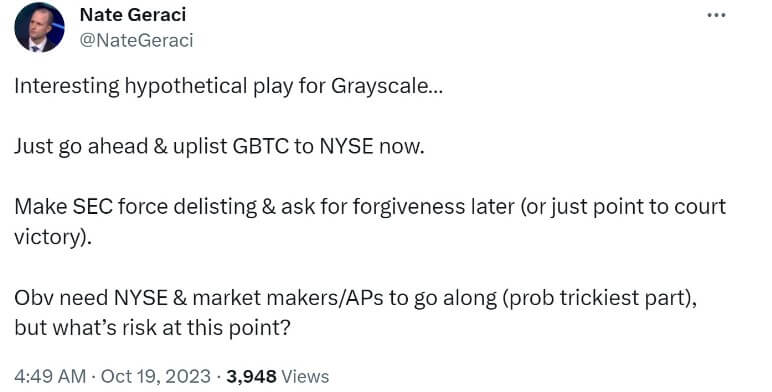

A Clever Plan Takes Shape

The brainchild behind this unconventional plan is Nate Gerachi, the president of the ETF Store. His idea is relatively straightforward: Grayscale could opt to list GBTC on the NYSE as an ETF without obtaining prior approval from the SEC.

Grayscale would take the initiative in this scenario, allowing the SEC to delist GBTC. Grayscale would then respond with either an apology or potentially cite a victory in court to justify their actions.

A Tug-of-War with Regulators

This concept’s central question is whether the NYSE would entertain such a maneuver. Even without the SEC’s blessing, convincing the NYSE to list GBTC as an ETF poses the most significant challenge. It would be an unprecedented move, and one cannot underestimate the influence of regulatory authorities.

The NYSE’s Love for ETFs

One aspect potentially favoring this proposal is the NYSE’s affinity for ETFs. The exchange has a history of embracing and championing these financial instruments. The NYSE sees ETF listings as a means to boost its offerings and trading volume. The advent of the first US spot bitcoin ETF on the NYSE could be a game-changer for the exchange.

Potential Ramifications

At worst, if the NYSE proceeds with such a listing without SEC approval, it could face potential repercussions. A fine might be the most immediate consequence. The SEC has not objected to GBTC being traded on the Over-the-Counter (OTC) market.

A Cover for Gensler?

This proposal also raises questions about the SEC’s stance. Gary Gensler, the SEC’s chairman, has been prominent in the cryptocurrency regulatory landscape. If the NYSE lists GBTC as an ETF without SEC approval, it would put Gensler in a precarious position. He could argue that the NYSE forced his hand and that the listing occurred against his preference, potentially giving him some political cover.

A Risky Gamble

While the idea of Grayscale leapfrogging the SEC is intriguing, it’s essential to consider the potential consequences. Engaging in such a maneuver carries inherent risks, not only for Grayscale but also for the broader cryptocurrency industry. It could set a precedent that regulators might not favor.

As this concept continues circulating within financial circles, it serves as a testament to the ever-evolving nature of the cryptocurrency landscape. It also highlights the ongoing tussle between innovation and regulation. Whether this plan will materialize remains uncertain, but it underscores the unconventional thinking that often defines cryptocurrency.