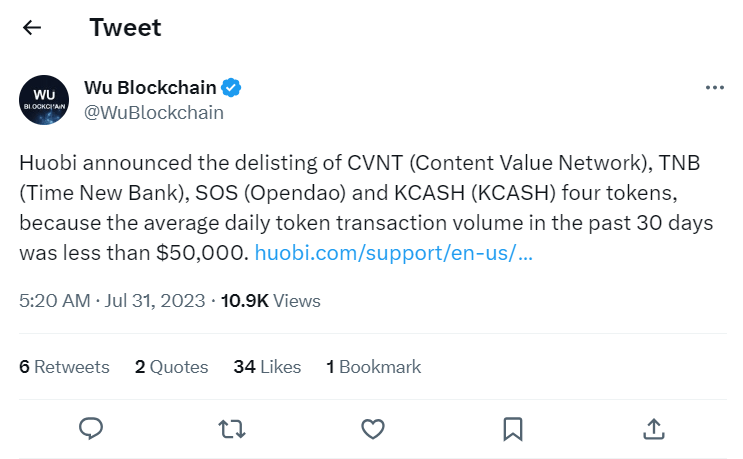

In a move aimed at upholding its reputation as a responsible cryptocurrency exchange, Huobi recently made the tough call to delist four tokens — CVNT, TNB, SOS, and KCASH — due to their consistently low transaction volumes. The decision came after a thorough evaluation of the tokens’ performance and liquidity, with the exchange emphasizing the need to protect its users from potential risks associated with trading illiquid assets.

While the announcement initially caused a temporary drop in prices as investors sought to liquidate their holdings, the broader market impact was minimal, underscoring the relatively insignificant influence of these tokens on the overall cryptocurrency market.

Table of Contents,

The Rationale Behind Delisting

Huobi’s decision to delist CVNT, TNB, SOS, and KCASH was not taken lightly. The exchange’s commitment to maintaining its platform’s integrity led to an extensive evaluation of these tokens’ trading data. Over the past 30 days, their average daily transaction volumes had dwindled significantly, falling well below the minimum threshold of $50,000 set by the exchange.

Such illiquid assets pose several risks, including heightened price volatility, potential manipulation, and limited exit options for investors. By delisting these tokens, Huobi sought to protect its user base from exposure to these risks while bolstering the overall confidence in its platform.

Temporary Market Response

Upon the delisting announcement, investors holding these tokens reacted swiftly, leading to a temporary price drop. However, the impact on the broader cryptocurrency market was minimal. That indicates that CVNT, TNB, SOS, and KCASH had limited influence on the overall market sentiment. It further highlights the need for users to be vigilant and cautious when investing in lesser-known tokens, as their fate can be determined by factors such as market interest, adoption, and liquidity.

Challenges Faced by the Delisted Tokens

CVNT, TNB, SOS, and KCASH were once considered promising projects with unique use cases. However, despite their potential, they encountered difficulties gaining traction and maintaining consistent trading volumes.

This lack of liquidity and demand made them susceptible to price manipulation and speculative trading, creating an environment where investors faced significant risks. While undoubtedly disappointing for supporters of these projects, the delisting decision serves as a cautionary reminder that innovative ideas must also be backed by solid execution and widespread adoption to thrive in the competitive cryptocurrency market.

Preserving User Trust and Platform Security

For a cryptocurrency exchange to thrive, it must prioritize user trust and platform security. Huobi’s delisting of CVNT, TNB, SOS, and KCASH is a testament to its commitment to ensuring traders access a safe and reliable environment. Huobi aims to protect its users from potential losses stemming from illiquid or underperforming assets by adhering to stringent criteria for listing and delisting tokens. This strategy also helps reduce the likelihood of market manipulation, safeguarding all participants’ interests and promoting the cryptocurrency ecosystem’s long-term health.

Conclusion

Huobi’s decision to delist CVNT, TNB, SOS, and KCASH may have disappointed some investors and supporters of these projects. Still, it underscores the exchange’s unwavering dedication to maintaining a trustworthy platform for all users. By delisting tokens with consistently low transaction volumes, Huobi aims to protect its user base from potential risks associated with trading illiquid assets.

This step also reminds the broader cryptocurrency market that projects must demonstrate sustained interest, adoption, and liquidity to thrive in this dynamic and competitive landscape. As the industry continues to evolve, responsible actions like this are crucial for ensuring the long-term sustainability and success of the cryptocurrency ecosystem.Earlier, we reported how the Bank of Italy’s Innovation Hub Embraces Polygon Labs and Fireblocks. Stick to us for more updates and crypto news!