In a recent turn of events that has sent ripples through the cryptocurrency market, Bitcoin experienced a notable 3% correction. This downturn coincided with Grayscale Bitcoin Trust (GBTC) investors offloading nearly $600 million worth of shares. This scenario has sparked a debate within the cryptocurrency community, shedding light on the intricate dynamics between institutional investment vehicles like GBTC and the broader Bitcoin market. This article delves into the implications of this substantial sell-off and its potential long-term impact on Bitcoin’s valuation and investor sentiment.

Table of Contents,

The GBTC Phenomenon and Its Market Impact

Grayscale Bitcoin Trust has long been a barometer for institutional interest in Bitcoin. Offering investors exposure to Bitcoin’s price movements without the need to directly purchase or store the cryptocurrency, GBTC has become a popular choice for those looking to dip their toes into the digital currency space. However, the trust’s structure, particularly its periodic lock-up periods and the premium or discount at which its shares trade relative to Bitcoin’s net asset value, can have pronounced effects on the market.

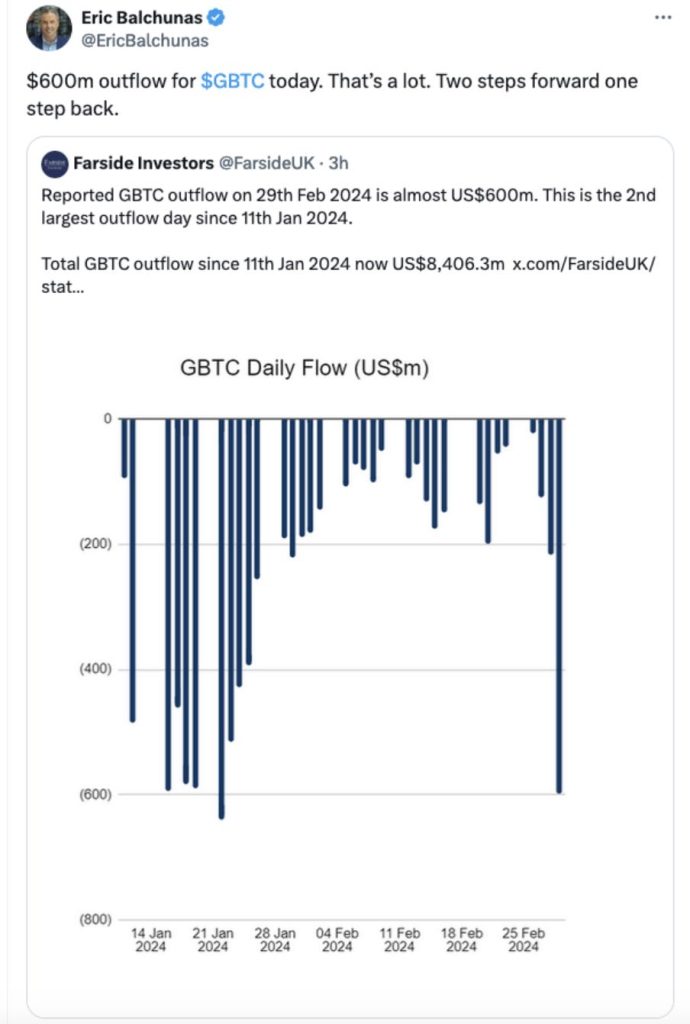

Unpacking the $600 Million Sell-Off

The decision by GBTC investors to dump nearly $600 million worth of shares is not merely a reflection of individual investment strategies but speaks volumes about broader market sentiment. Several factors could have contributed to this mass sell-off, including concerns over Bitcoin’s short-term price trajectory, the diminishing premium of GBTC shares, or a strategic move to liquidate positions in anticipation of alternative investment opportunities within the crypto space or beyond.

Bitcoin’s 3% Correction: A Cause for Concern?

On the surface, a 3% correction in Bitcoin’s price may seem minor, especially considering the cryptocurrency’s historical volatility. However, the timing and context of this correction—closely following the GBTC sell-off—raise questions about the underlying stability of Bitcoin’s price and the influence of institutional investors on the market. Critics argue that the incident underscores the susceptibility of Bitcoin to large-scale sell-offs, potentially undermining the narrative of Bitcoin as a “digital gold” immune to traditional market pressures.

Looking Ahead: Implications for Bitcoin and Institutional Investment

The recent GBTC sell-off and subsequent Bitcoin correction serve as a critical reminder of the growing pains of a maturing market. As institutional investors continue to play an increasingly significant role in the cryptocurrency space, their actions—ranging from large-scale buy-ins to sudden sell-offs—will undoubtedly continue to impact Bitcoin’s price and volatility.

However, proponents of Bitcoin argue that the cryptocurrency’s fundamentals remain strong, pointing to increasing adoption, technological advancements, and its role as a hedge against inflation. They contend that while institutional movements can influence short-term price actions, the long-term trajectory of Bitcoin is determined by its intrinsic value and utility.

Conclusion

The recent 3% correction in Bitcoin’s price, triggered by a substantial sell-off of GBTC shares, has sparked a debate about the influence of institutional investors on the cryptocurrency market. While some view these developments with concern, others see them as part of Bitcoin’s journey towards mainstream acceptance and maturity. As the cryptocurrency ecosystem continues to evolve, understanding the interplay between institutional investment vehicles like GBTC and Bitcoin’s market dynamics will be crucial for investors navigating this volatile landscape.