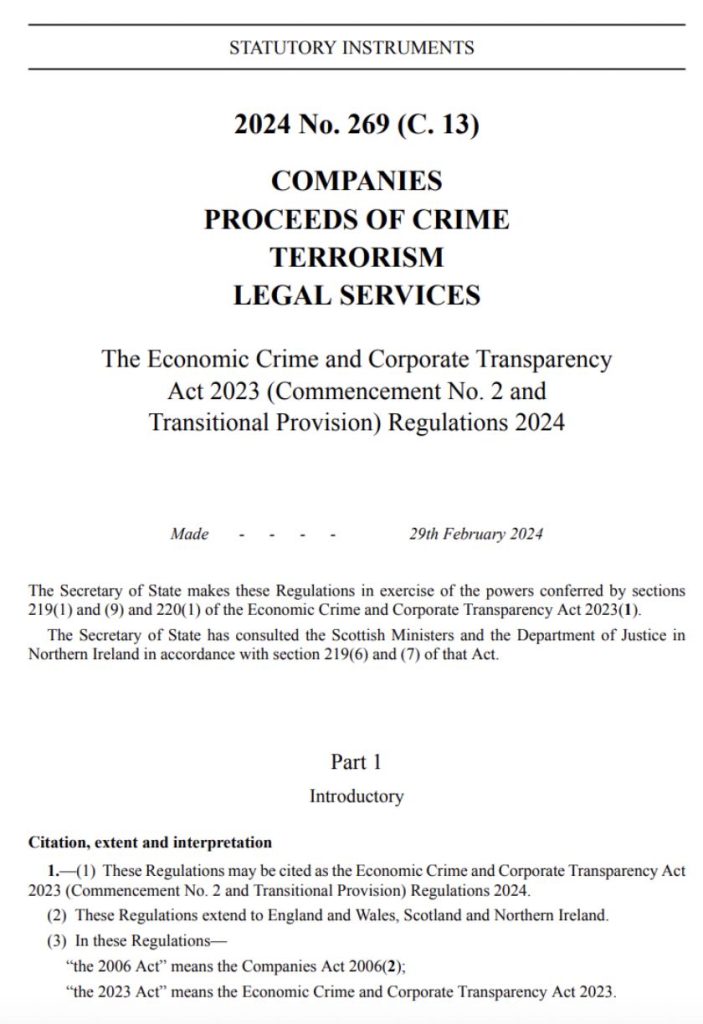

In an evolving digital finance landscape, the United Kingdom is set to implement changes that will significantly empower authorities with fewer restrictions when it comes to seizing cryptocurrencies. This move, while contentious, underscores a crucial shift towards strengthening regulatory frameworks to combat financial crimes in the crypto space. As cryptocurrencies continue to gain mainstream acceptance, the need for robust regulatory measures has never been more apparent. This article delves into the implications of the UK’s upcoming policy changes, arguing that while they present challenges, they are a necessary step towards a more secure and transparent cryptocurrency ecosystem.

Table of Contents,

The Rationale Behind the Policy Shift

The UK’s decision to ease the process for authorities to seize cryptocurrencies is not without foundation. The digital nature of cryptocurrencies, coupled with the anonymity they can afford, has unfortunately made them attractive for illicit activities, including money laundering and financing terrorism. By reducing the barriers for authorities to intervene and seize assets associated with criminal activities, the UK aims to send a clear message about its stance on financial crimes in the crypto space.

Balancing Regulation with Innovation

Critics argue that increased regulatory powers could stifle innovation and deter investment in the UK’s cryptocurrency market. There is a delicate balance to be struck between ensuring a secure financial environment and nurturing the growth of the crypto industry. However, proponents of the policy change assert that establishing a well-regulated space is crucial for long-term sustainability and investor protection. By setting clear regulatory standards, the UK could enhance its reputation as a safe and reliable hub for crypto investments, ultimately fostering innovation within a secure framework.

Implications for Crypto Users and Exchanges

For individual crypto users and exchanges, the impending policy changes signal the importance of compliance and due diligence. Exchanges operating within the UK may need to bolster their Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to align with the new regulatory expectations. For users, it underscores the necessity of engaging with cryptocurrencies through legitimate channels and for lawful purposes. While some may view these measures as intrusive, they are essential for protecting the integrity of the crypto ecosystem and its participants.

The Path Forward: Collaboration and Clarity

The successful implementation of the UK’s new crypto seizure policies will require close collaboration between regulatory bodies, crypto exchanges, and users. Clear communication and transparency about the scope and intent of the regulations will be key to mitigating concerns and ensuring compliance. Furthermore, authorities must remain vigilant to the evolving landscape of digital finance, ready to adapt policies as necessary to address emerging challenges without hampering innovation.

Conclusion

The UK’s move to empower authorities with fewer restrictions when seizing cryptocurrencies represents a critical step in enhancing the regulatory framework surrounding digital assets. While it poses certain challenges, particularly regarding the balance between regulation and innovation, it is a necessary evolution in the fight against financial crimes in the crypto space. By fostering a secure and transparent environment, the UK not only protects its citizens but also solidifies its position as a leading center for crypto activity. As the digital finance realm continues to expand, proactive regulatory measures like these will be vital in shaping a resilient and thriving cryptocurrency ecosystem.