In the rapidly evolving world of cryptocurrency mining, companies like Riot Platforms are grappling with a dual threat: the ongoing global chip shortage and increasingly stringent environmental, social, and governance (ESG) regulations. These challenges not only threaten the operational efficiency and profitability of mining operations but also raise critical questions about the sustainability and future direction of the cryptocurrency mining industry.

Table of Contents,

The Chip Shortage Dilemma

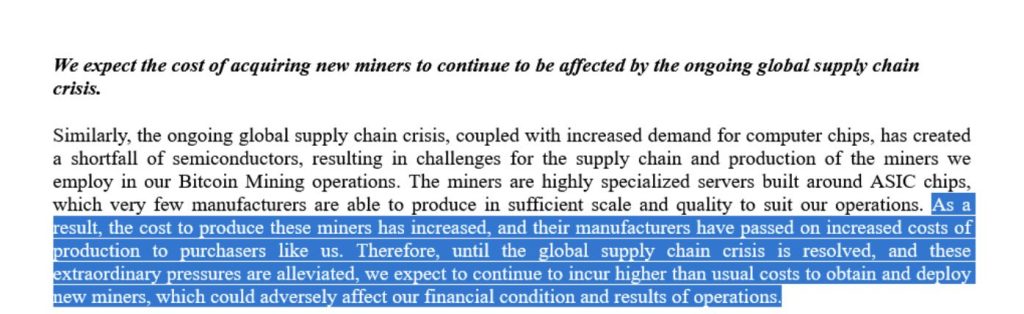

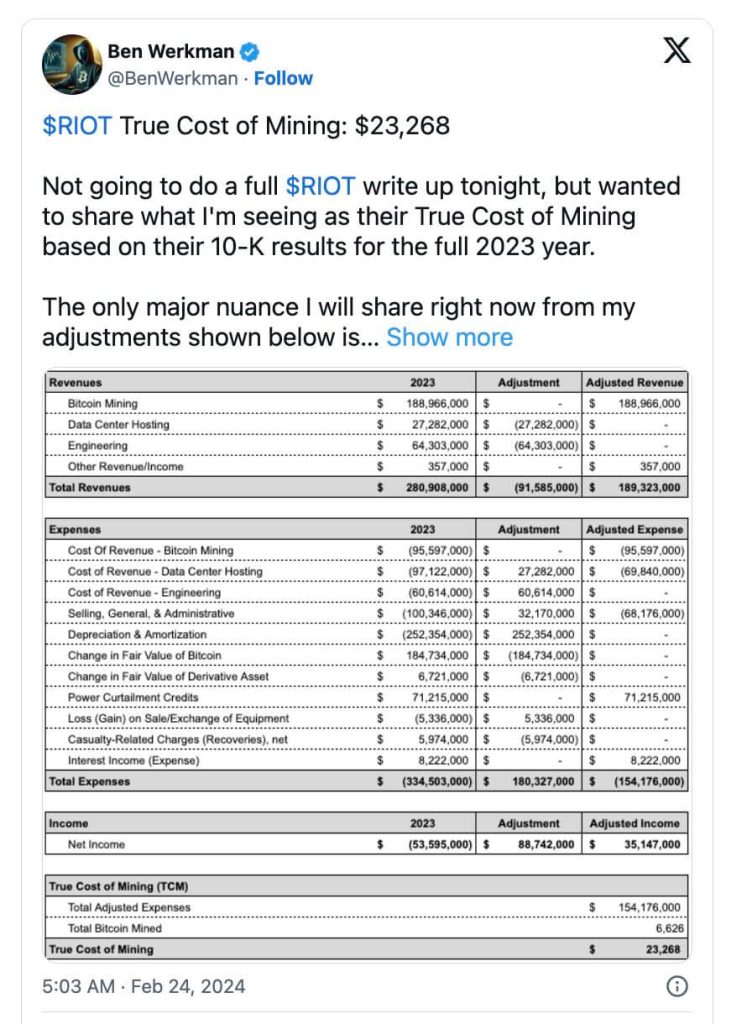

The global semiconductor chip shortage, a consequence of disrupted supply chains and skyrocketing demand across multiple industries, has hit cryptocurrency miners hard. For companies like Riot Platforms, which rely on cutting-edge hardware to stay competitive, the scarcity of chips has become a significant bottleneck. The shortage limits the ability to scale operations, improve hash rates, and, most importantly, maintain profitability in a market where timing and computational power are everything. As miners scramble for the limited supply of available chips, the cost of mining equipment skyrockets, squeezing margins and putting smaller operators at risk.

ESG Regulations Tighten

Simultaneously, the cryptocurrency mining sector is facing growing scrutiny over its environmental impact, particularly concerning its substantial energy consumption and carbon footprint. ESG regulations are becoming more stringent, pushing miners to adopt greener practices and transition to renewable energy sources. While this shift aligns with global sustainability goals, it poses significant challenges for miners. Transitioning to renewable energy sources requires substantial investment and time, and in regions where green energy is scarce or expensive, it can drastically increase operational costs.

For Riot Platforms and similar companies, these ESG regulations not only represent a risk to current operations but also a fundamental challenge to the traditional mining model. The pressure to comply with these regulations comes from various stakeholders, including investors, customers, and governments, making it a pivotal issue that could shape the future of the industry.

The Road Ahead: Risks and Opportunities

Despite these challenges, there’s a silver lining for Riot Platforms and other miners willing to innovate and adapt. The chip shortage has sparked a push towards more efficient mining technologies and strategies that could reduce dependency on high-demand components. Moreover, the focus on ESG compliance has the potential to drive the industry towards more sustainable and socially responsible practices, potentially enhancing its public image and acceptance.

However, navigating these risks will require strategic foresight, significant investment, and a willingness to pioneer new approaches to mining. For instance, exploring partnerships with renewable energy providers, investing in R&D for energy-efficient mining technologies, or even diversifying operations to include crypto-related services beyond mining could be viable strategies.

Conclusion

While Riot Platforms and other cryptocurrency miners are currently facing significant risks due to the global chip shortage and tightening ESG regulations, these challenges also present opportunities for transformation and innovation. By addressing these issues head-on, the mining sector can not only mitigate these risks but also position itself for sustainable growth in the evolving digital economy. The path forward is fraught with uncertainties, but for those willing to adapt, it offers a chance to redefine the future of cryptocurrency mining.