In a move that has reverberated through the cryptocurrency world, MicroStrategy has once again made headlines by purchasing an additional $37 million worth of Bitcoin, bringing its total holdings to a staggering 190,000 BTC. This latest acquisition underscores the company’s unwavering commitment to Bitcoin as a cornerstone of its investment strategy, even as the cryptocurrency market continues to exhibit high volatility. This development prompts a crucial question: Is MicroStrategy’s aggressive accumulation of Bitcoin a display of strategic foresight or a perilous gamble in an uncertain market? As we delve into this topic, decentrahacks.com aims to unravel the complexities of MicroStrategy’s strategy, examining the potential risks and rewards from both a financial and strategic perspective.

The Case for Strategic Genius

- Inflation Hedge: In an era of unprecedented monetary expansion and concerns over inflation, Bitcoin is increasingly viewed as a ‘digital gold,’ offering a hedge against fiat currency devaluation. MicroStrategy’s substantial investment in Bitcoin can be seen as a prudent move to preserve the company’s wealth over the long term.

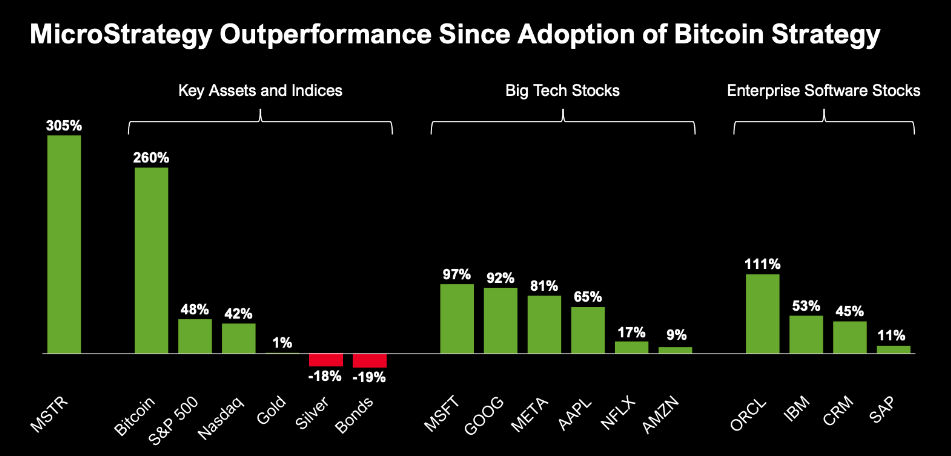

- Early Adopter Advantage: By positioning itself as one of the largest corporate holders of Bitcoin, MicroStrategy could reap significant benefits from the cryptocurrency’s potential mainstream adoption and price appreciation. The company’s early and sustained investment in Bitcoin may place it ahead of the curve, potentially yielding substantial returns as digital currencies gain broader acceptance.

- Diversification Strategy: For MicroStrategy, investing in Bitcoin represents a diversification of its asset portfolio, reducing exposure to traditional financial markets and assets. This strategy could safeguard the company against market downturns in more conventional investment areas.

The Case for High-Stakes Gamble

- Market Volatility: Bitcoin’s price is notoriously volatile, with dramatic fluctuations that can lead to significant losses. MicroStrategy’s substantial investment in Bitcoin exposes the company to considerable financial risk, particularly if the market experiences a sharp downturn.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear and varies significantly across jurisdictions. Potential regulatory crackdowns or unfavorable policies could adversely affect Bitcoin’s value and, by extension, MicroStrategy’s holdings.

- Concentration Risk: By allocating a significant portion of its resources to Bitcoin, MicroStrategy risks having an overly concentrated investment portfolio. This lack of diversification could be detrimental if Bitcoin fails to perform as expected, potentially compromising the company’s financial stability.

Conclusion

MicroStrategy’s decision to invest heavily in Bitcoin is a bold move that epitomizes the company’s confidence in the digital currency as a viable asset class. Whether this strategy is viewed as a display of foresight or a gamble, it undoubtedly highlights the diverging opinions on the role and future of cryptocurrencies in corporate investment portfolios. As MicroStrategy continues to navigate the volatile cryptocurrency market, its journey offers valuable insights into the challenges and opportunities presented by digital assets. The outcome of this strategy will likely serve as a case study for other corporations contemplating similar investments in the future, underscoring the evolving relationship between traditional business strategies and the burgeoning world of cryptocurrencies.