Decentralized finance (DeFi) has been a revolutionary force in cryptocurrencies, offering financial inclusivity and freedom to individuals worldwide. However, a recent development in the Uniswap V4 ecosystem has ignited a contentious debate within the crypto community. Uniswap, one of the most popular decentralized exchanges, introduced a customizable “Know Your Customer” (KYC) hook.

This seemingly innocuous addition has ignited a controversy that underscores the delicate balance between DeFi’s libertarian ethos and regulatory scrutiny.

You might also be interested: Cyprus Enforces Strict Penalties for Unregulated Crypto Service Providers — learn more here.

Table of Contents,

Understanding the KYC Hook

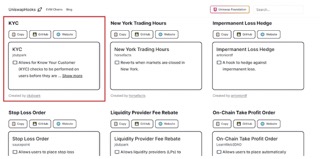

Before delving into the controversy, it’s essential to comprehend the nature of this KYC hook. In software development, a “hook” is a tool that enables developers to modify code without altering the core structure of a program. In Uniswap V4, this hook allows developers to incorporate KYC verification within the DeFi protocol. KYC, short for Know Your Customer, is a process mostly used by financial institutions to verify the identities of customers and assess potential risks. Its primary aim is to detect and prevent money laundering and terrorist financing activities.

A community developer introduced The KYC hook as an optional feature in Uniswap V4’s directory. KYC verification is implemented through nonfungible tokens (NFTs). Proponents argue that this KYC tool is primarily designed for liquidity providers and may benefit projects that must adhere to regulatory requirements in specific jurisdictions.

The Pro-KYC Argument

Supporters of the KYC hook argue that it has a place in the DeFi ecosystem for several compelling reasons.

- Legal Compliance: For many projects, especially those operating in highly regulated jurisdictions, adhering to KYC procedures is not just a preference but a legal necessity. The KYC hook allows these projects to remain compliant with local laws and regulations, enabling DeFi to coexist with the traditional financial system.

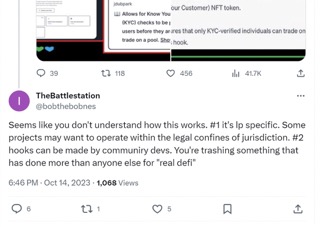

- Developer Freedom: DeFi has thrived on the principles of open-source development and community contributions. Introducing customizable hooks aligns with these principles, allowing developers to make choices that suit their projects’ unique needs. Supporters see this as an extension of the innovation that has driven DeFi’s growth.

- A Matter of Perspective: Some argue that vilifying the KYC hook neglects the positive contributions that Uniswap and the broader DeFi community have made to decentralized finance. They emphasize that DeFi’s aim is not to undermine the rule of law but to provide an alternative financial ecosystem that can coexist with traditional finance.

The Anti-KYC Perspective

Conversely, critics of the KYC hook view it as a potential slippery slope that leads to DeFi protocols being allowed by regulators, thus undermining the fundamental principles of decentralization and financial freedom.

- Regulator Allowlisting: A central concern is that initially introduced as an option for liquidity providers, the KYC hook might eventually evolve into a “regulator allowlist approved” database hosted off-chain. That could lead to transactions not adhering to KYC standards being labeled as illegal, thus jeopardizing the core DeFi principle of financial inclusivity.

- Erosion of DeFi’s Essence: Detractors argue that the introduction of KYC mechanisms not only contradicts the libertarian ideals of DeFi but also risks undermining users’ trust in decentralized exchanges. These mechanisms may be an overreach that could eventually result in the centralization of DeFi protocols, thereby negating their intended purpose.

The Road Ahead

The controversy surrounding Uniswap V4’s KYC hook raises essential questions about the future of DeFi. This debate is far from over as governments worldwide tighten regulations on cryptocurrencies and DeFi. While some proponents view KYC as necessary for DeFi’s mainstream adoption and coexistence with the traditional financial system, critics are concerned about potential overregulation and the erosion of the sector’s core principles.

The Uniswap V4 KYC hook serves as a microcosm of the broader challenges faced by DeFi. Striking a balance between maintaining its core principles of decentralization and financial freedom and conforming to regulatory requirements will be a real challenge for DeFi platforms in the coming years. As Uniswap V4’s KYC hook approaches its 2024 release, the crypto community must engage in a constructive dialogue to shape the future of DeFi in a manner that aligns with its core principles and regulatory realities. The outcome of this debate will undoubtedly shape the future of decentralized finance, and its implications will be far-reaching.