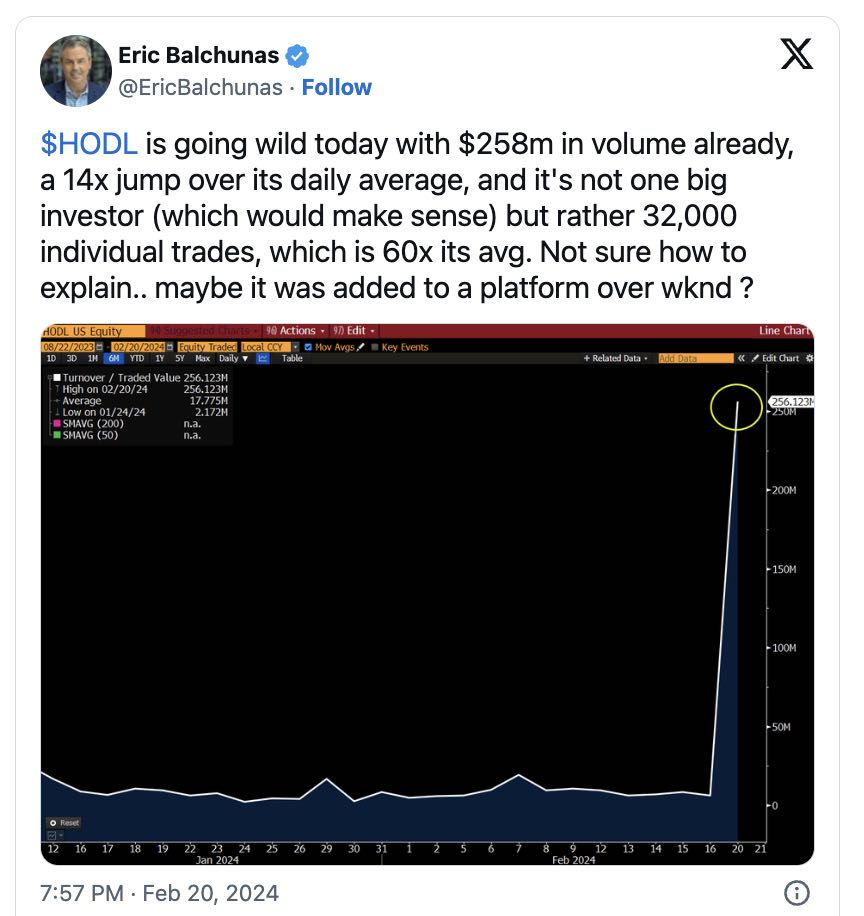

In a striking display of market dynamics, VanEck’s Bitcoin Exchange-Traded Fund (ETF) has recorded an astonishing 1,400% increase in daily trading volume. This surge has sparked a spirited debate within the financial and cryptocurrency communities. Advocates hail it as a sign of Bitcoin’s growing mainstream acceptance and the potential stabilization of the cryptocurrency market. Critics, however, caution against premature celebration, pointing to the inherent volatility of the crypto market and the speculative nature of such rapid increases in trading volume. This article for decentrahacks.com delves into the arguments on both sides, examining the implications of VanEck’s Bitcoin ETF’s remarkable trading volume spike.

Table of Contents,

The Bullish Perspective: Signaling Mainstream Acceptance

Proponents of the optimistic view argue that the 1,400% increase in trading volume for VanEck’s Bitcoin ETF represents a significant milestone in the journey of cryptocurrencies towards mainstream financial acceptance. Key points include:

- Institutional Investment: The surge in trading volume is seen as evidence of increasing institutional interest in Bitcoin, suggesting that more traditional investors are now considering cryptocurrencies as a viable part of diversified portfolios.

- Regulatory Milestones: The successful listing and trading of a Bitcoin ETF on major stock exchanges are viewed as a triumph over regulatory hurdles, potentially paving the way for more crypto-based financial products in the future.

- Market Maturation: Advocates argue that the influx of capital into Bitcoin ETFs could lead to a reduction in volatility, as the presence of more regulated investment vehicles provides a stabilizing effect on the market.

The Bearish Stance: A Caution Against Market Volatility

On the flip side, skeptics of the surge in trading volume warn that it may not necessarily herald a new era of stability or acceptance for cryptocurrencies. Their concerns include:

- Speculative Trading: Critics argue that the dramatic increase in volume could be driven by speculative trading rather than genuine investor confidence in Bitcoin’s long-term value, which may lead to increased market volatility.

- Regulatory Uncertainty: Despite the approval of VanEck’s Bitcoin ETF, the regulatory landscape for cryptocurrencies remains complex and fluid. Skeptics caution that future regulatory challenges could impact the market negatively.

- Market Manipulation Risks: The possibility of market manipulation in relatively unregulated or emerging markets like cryptocurrencies is a concern, with critics worrying that sudden spikes in trading volume could be indicative of such activities.

Conclusion: A Balanced Viewpoint

The 1,400% increase in daily trading volume of VanEck’s Bitcoin ETF undeniably marks a moment of significance in the cryptocurrency market. While it may signal increasing institutional interest and a step towards mainstream financial acceptance, it also raises questions about market volatility and the sustainability of such rapid growth. As the cryptocurrency market continues to evolve, the journey of Bitcoin ETFs like VanEck’s will be closely watched by both proponents and skeptics alike. The debate over the implications of this trading volume spike underscores the complex interplay between innovation, regulation, and market dynamics in the world of cryptocurrencies. Whether this event will be looked back upon as a milestone in market maturation or a cautionary tale of speculative excess remains to be seen.