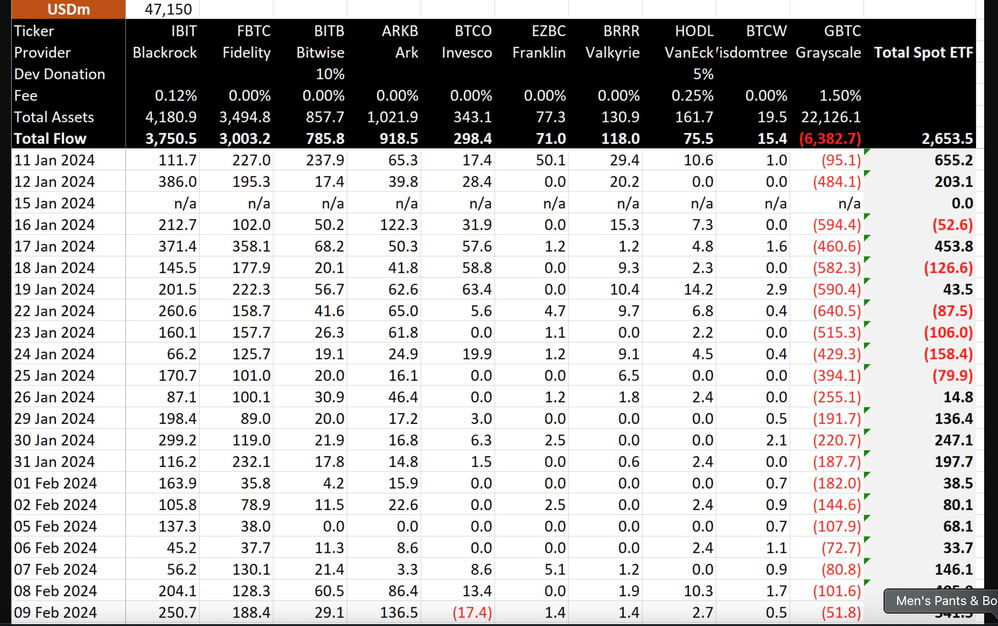

The cryptocurrency landscape has reached a pivotal milestone, with Bitcoin Exchange-Traded Funds (ETFs) amassing an impressive $10 billion in assets under management (AUM) merely one month after receiving regulatory approval. This unprecedented achievement has ignited a fervent debate within the crypto and financial communities, posing a crucial question: Does this rapid accumulation signify a leap forward for cryptocurrency mainstream acceptance and investment, or is it an inflated bubble poised to burst? As we navigate through this discussion, decentrahacks.com aims to dissect the arguments, providing insights into the implications of this milestone for the future of Bitcoin and the broader financial market.

Table of Contents,

The Case for a Leap Forward

Proponents of the Bitcoin ETFs argue that reaching the $10 billion milestone in such a short period is a testament to the growing acceptance and legitimacy of cryptocurrency as an investment class. They highlight several factors underpinning this perspective:

- Mainstream Adoption: The success of Bitcoin ETFs reflects a significant shift towards mainstream adoption of cryptocurrencies. By providing a regulated, traditional investment vehicle for Bitcoin, ETFs lower the barrier to entry for individual and institutional investors who may have been wary of the complexities and risks associated with direct crypto investments.

- Market Confidence: The rapid inflow of capital into Bitcoin ETFs signals strong market confidence in the potential of Bitcoin as a digital asset. This confidence may stem from Bitcoin’s perceived role as a hedge against inflation and a digital alternative to gold.

- Regulatory Milestone: The approval of Bitcoin ETFs by regulatory authorities is seen as a vote of confidence in the stability and maturity of the cryptocurrency market. It marks a significant step towards integrating digital assets into the conventional financial system, potentially paving the way for more cryptocurrency-based financial products.

The Bubble Concern Argument

On the flip side, skeptics caution against overly optimistic interpretations of the Bitcoin ETFs’ early success. They point to concerns that suggest the $10 billion milestone may be more indicative of speculative fervor than genuine market growth:

- Speculative Investment: Critics argue that the rapid accumulation of AUM in Bitcoin ETFs could be driven by speculative investment rather than long-term confidence in Bitcoin’s value. This speculation could lead to increased volatility and the risk of a market correction if investor sentiment shifts.

- Regulatory Uncertainty: Despite the recent approval of Bitcoin ETFs, the regulatory landscape for cryptocurrencies remains complex and subject to change. Future regulatory actions could impact the viability and attractiveness of Bitcoin ETFs, potentially affecting their market performance.

- Market Saturation: There is also concern that the influx of Bitcoin ETFs could lead to market saturation, diluting the impact of individual funds and heightening competition. This saturation could challenge the sustainability of the growth seen in the immediate aftermath of regulatory approval.

Conclusion

The Bitcoin ETFs’ achievement of the $10 billion milestone within a month of approval is a momentous event that has sparked a wide-ranging debate about the future of cryptocurrency investments. While proponents see it as a sign of market maturity and mainstream acceptance, skeptics warn of potential speculative bubbles and regulatory challenges ahead. As the market continues to evolve, it will be crucial for investors, regulators, and the crypto community to navigate these dynamics carefully, ensuring that the growth of Bitcoin ETFs contributes to the healthy and sustainable development of the broader cryptocurrency ecosystem.