Do you want to invest in Ethereum (ETH)? It is one of the most popular cryptocurrencies on the market today, and its price has seen a significant rise over the past few years.

Many factors will influence how much money your investment could make. These include the demand for Ether, regulations affecting cryptocurrency markets, and changes in technology utilized by Ethereum. In this article, we’ll explore some potential scenarios to help you understand what might happen if you invest $100 in ETH today.

Table of Contents,

What Is Ethereum? ⚙️

Ethereum is an open-source blockchain platform that lets developers build and deploy dApps. It was launched in 2015 to offer an alternative to existing blockchain networks such as Bitcoin.

The network differs from other blockchains in that it allows users to create their own tokens, smart contracts, and dApps on its platform. As a result, this coin has become a popular choice for businesses looking to develop new technologies or expand into the cryptocurrency space.

Is Ethereum a Good Investment in 2023? 📊

Current Coin Stats and Market Conditions

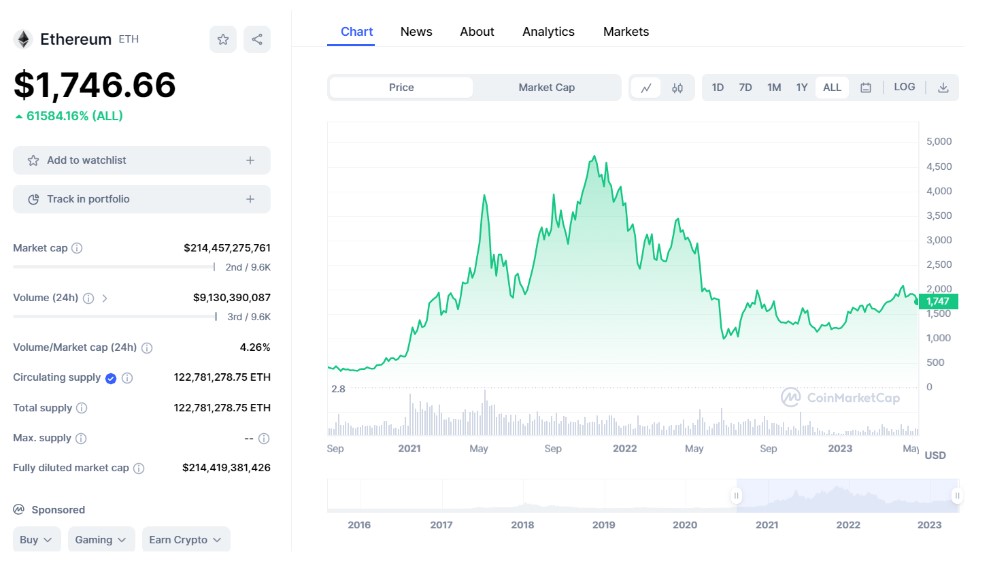

In 2016, the price of ETH was 0.41 USD, which is the lowest it has ever been. Since then, it has had several significant bullish spikes. The first was in 2017 — 2018, when it peaked at the 1400 mark. The price subsequently dropped to $400 before early 2021. Since the beginning of that year, bullish moods have lifted the coin to over $4000.

The price of ETH has been steadily increasing since its launch in 2015, and it continues to attract more investors as the technology behind it develops. Furthermore, with the rise of decentralized finance (DeFi) applications built on top of Ethereum, many experts are bullish about the future of ETH. Therefore, if you’re looking to invest your money into a long-term project with potential for growth and profits, Ethereum could be it.

Only in the last minutes of 2021 did ETH cross that threshold, continuing its rise to $4890 in November 2021. Since then, the price has been volatile and generally trended downward. At present, its price is around $1750.

The coin has been trading below $1,500 per token recently, but many investors are optimistic about its potential to climb back above. This positive sentiment is fueled by the recent rise in cryptocurrencies, which has given hope that the worst of the crypto winter may have passed.

However, rising prices, the possibility of a global recession, and central bank rates are putting stocks and cryptocurrency markets in difficulty after a strong beginning in 2023. As for now, Ethereum is down about 64% since hitting an all-time high of $4,891 in November 2021, with the Federal Reserve’s response to inflation being the main reason for the drop.

Despite these problems, the coin has been up 40% in the last six months, and the broader cryptocurrency market is on the rise, thanks to the FDIC’s announcement to support all deposits at Silicon Valley Bank. But the Federal Reserve’s need to keep raising interest rates to fight inflation could hurt the price of ETH, and the Fed could eventually raise interest rates to 8%.

Should You Invest in Ethereum While It Is Under $2000?

Ethereum has been trading under $2000 for some time, so many investors wonder if now is a good time to buy ETH. However, the long-term potential should not be overlooked, and buying while a low price could pay off in the future.

Investing in the asset depends on your long-term outlook and risk tolerance, as the cryptocurrency as a whole is still largely speculative. Moreover, The Fed’s aggressive rate hike cycle and the risk of recession have taken a toll on risky assets such as stocks and cryptocurrencies.

Still, the coin has the potential to be a good long-term investment for the next one to three years, but there are no guarantees in cryptocurrencies. So before investing, you must check your finances, diversify your portfolio, and be prepared for short-term volatility.

While there are no guarantees on returns, investing today could allow you to capitalize on future price rises. For example, as the demand for crypto grows and technological advances, it’s possible that ETH could reach prices significantly higher than its current level.

Ethereum could even return to its all-time high or even higher if the current restrictive environment eases, but this scenario is unlikely to happen soon. Ultimately, it is impossible to predict with certainty how high Ethereum will rise.

Can You Get a Good ROI in 2023-2025?

The potential returns on your investment in the coin will depend mainly on the price of ETH at the time you sell it. Currently, it is trading below $2000 and, as such, could offer an excellent opportunity for investors looking to benefit from future price increases.

Developers are working hard on updates to enhance the network. For example, The Merge and Shanghai updates have already successfully moved Ethereum from a PoW protocol to PoS, improving the mining process. Moreover, future updates are expected to improve efficiency and reduce fees, with the most significant updates scheduled for the nearest years.

Given the current market conditions, there’s potential for significant ROI if you choose to invest now. However, it’s necessary to remember that cryptocurrency markets are highly volatile, and the price of ETH could rise or fall at any time. Therefore, investing in Ethereum comes with a certain degree of risk.

You may wonder how much Ethereum should I buy. Ultimately, the amount of return you get on your investment will depend on how much you put in and how well you manage the risks associated with investing. Therefore, it’s essential to do your research for success before committing any capital and only invest what you can afford to lose. You can also check these tips for the most current crypto news updates.

Strengths and Weaknesses of Ethereum 🤔

How Is Ethereum Beneficial for You?

Why buy Ethereum? The ecosystem offers several benefits for investors, including the potential to earn high returns over time. In addition, Ethereum’s blockchain technology gives it increased security and reliability compared to other blockchains:

- It is an attractive choice for businesses developing new technologies or expanding into the cryptocurrency space.

- Since it is decentralized, it can give users greater control over their funds and transactions.

- Ethereum also boasts of being the best platform for decentralized applications (dApps). This is also an open-source blockchain, which allows developers to create new projects on its network, potentially benefiting Ethereum in the long run. In addition, it can host other cryptocurrencies on its blockchain, including well-known projects such as Decentraland, The Sandbox, Polygon, and Shiba Inu.

With all these benefits combined, the network has quickly become one of the most widely used blockchains today.

What Are ETH’s Drawbacks?

Though Ethereum has many benefits, it also comes with some drawbacks.

- The network is experiencing difficulties due to low transaction speeds and high gas tariffs, which can cause user dissatisfaction.

- Because of its decentralized nature, Ethereum is not backed by any government or institution, and its value can be highly volatile. Furthermore, since the chain is an open-source platform and anyone can build on it without permission or oversight from developers or authorities, there is always a risk that malicious actors may exploit weaknesses in smart contracts or dApps built on top of it.

How to Buy Ethereum? 💵

There are several ways to buy ETH, but which one is the best, and where to start? Let’s take a look at the different options.

Methods to Buy ETH

1) Crypto exchange

Among the simplest methods to buy the coin is to trade it on a crypto exchange. These platforms are available online and allow you to buy, sell, and trade cryptocurrencies using traditional fiat currencies, such as the USD or Euro, along with other crypto coins.

Several factors to consider when selecting a platform include the level of security, commissions, supported payment options, and the range of coins offered.

2) P2P exchange

Another way to purchase the asset is through a peer-to-peer (P2P) trading platform. P2P platforms allow direct connections between buyers and sellers, eliminating the demand for intermediaries such as crypto exchanges.

P2P marketplaces allow you to purchase ETH using a wider variety of payment options, including wire transfers, cash deposits, and gift cards in some marketplaces.

3) Decentralized exchange (DEX)

Decentralized Exchanges (DEX) are one more method to buy crypto. Unlike centralized platforms (CEX), run by a single organization, DEXs are entirely peer-to-peer and based on decentralized networks.

DEX provides various benefits over CEX, including increased safety and confidentiality, lower commissions, and no necessity for a central authority to control operations.

4) Crypto ATM

You can use a crypto or Bitcoin ATM if you prefer to buy crypto in person rather than online. Bitcoin ATMs are self-service machines that let you acquire crypto using debit/credit cards or cash.

Although Bitcoin ATMs are primarily designed to buy Bitcoin, most also allow you to purchase other cryptocurrencies. But Bitcoin ATMs usually have higher charges than P2P platforms or online exchanges.

Once you understand the different ways to acquire crypto, let’s look at the steps involved in buying it through a crypto exchange.

Steps to Buy ETH

Set up an account on a platform

You first need to create an account to buy and sell cryptocurrencies on most exchanges. While the process for creating an account may vary from exchange to exchange, you will usually be required to provide a name, password, and email address. In addition, certain exchanges may require you to go through a KYC (“know your customer”) procedure before you can begin trading. KYC may include providing personal information such as a picture of yourself with ID, proof of address, and a government-issued ID.

Fund your account

After successfully setting up an account, you will need to deposit funds into it. Exchanges usually allow a variety of payment methods, including debit cards, digital wallets, and bank transfers. Be sure to check for deposit limits before funding your account.

Buy ETH

When you have made the deposits, you can proceed with buying the coin. Most exchanges provide a trading interface where you can place buy and sell orders. Simply select Ethereum from the list of available cryptocurrencies, enter the amount you wish to purchase, and then submit your order. The platform will then pair your order with a sell order from someone else and complete the transaction. Several exchanges can charge a trading fee, so be sure to familiarize yourself with the fee structure before submitting your order.

Withdraw ETH to your personal wallet

Once you have acquired the asset, it is highly suggested that you withdraw it to your personal wallet for storing it. To do this, create a wallet address from your wallet and enter it into the withdrawal section of the exchange. The platform will then transfer your ETH to your wallet address. Certain exchanges may also charge extra fees.

Final Words 👋

Ethereum is a popular cryptocurrency with a wide range of applications. Thus, it is an excellent long-term investment with the potential to yield high returns. However, it’s vital to understand that investing in ETH comes with volatility. Therefore, perform extensive research and consider your own financial goals and risk tolerance before investing in the coin.

To maximize your chances of success, use dollar-cost averaging when buying ETH and keep an eye on market trends so you can make informed decisions about when to buy or sell. As always, remember never to invest more than what you are comfortable losing, and consider diversifying your portfolio for added protection against risk.

Frequently Asked Questions ❓

A small stake in ETH might make sense in the long run. But we caution against investing too much in any crypto asset because coins are highly volatile and often subject to significant declines.

In terms of trading in the next three or five weeks, we have a neutral stance, which means we expect stable prices. As for 2023 as a whole, recession risks threaten ETH, so if you take a medium-term view, now may not be the best time to buy the crypto. However, in general, we are bullish and believe that ETH is an excellent long-term investment for the 2023 — 2025 period. This means we are looking forward to increasing prices over the long period.

Conventional wisdom tells investors to purchase at low prices and sell at high. However, it depends on your financial goals, risk tolerance, and investment horizon, whether you should sell it or not. While some sites claim that particular days of the week are better or worse than others for selling Ethereum, any decision should be based on understanding of cryptocurrency fundamentals.

Like all investments, the price of ETH can both fall or rise. Experienced investors advise a small allocation of funds and portfolio diversification. You should never invest what you are unable to lose.

To buy ETH or another crypto coin, you must have access to a cryptocurrency exchange. You can gain it through different methods, such as Binance, Trust Wallet, or Coinbase, each with a separate fee policy. Thus do your research to determine which one is best for your demands.

Tokens can be very volatile, and a way to combat this is to use a strategy called averaging. This involves dividing the overall sums you struggle to invest into separate buys of the target coin. You will invest the analogical sum each quarter, not depending on market conditions.

When prices go up, you can afford fewer coins. However, when prices drop, you can allow yourself more. Then when the situation is changed, you profit from buying more assets at a lower price. However, be aware that this method does not guarantee you profits.