Cryptocurrency enthusiasts and investors have been eagerly counting down to a significant event in the world of Bitcoin, known as the “Bitcoin Halving” or “Halvening.” In this article, we’ll delve into the essence of Bitcoin halving, its historical impact, and why the upcoming 2024 halving generates substantial excitement. You might also be interested: ZeroSync Implements the First ZK Client for Bitcoin

Table of Contents,

The Essence of Bitcoin Halving

Understanding Bitcoin Rewards

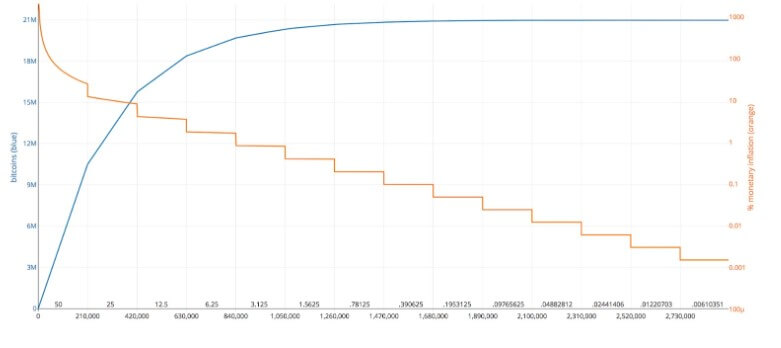

New bitcoins are issued into circulation approximately every 10 minutes through a process known as mining. However, what sets Bitcoin apart is its unique economic design. The network rewarded miners with 50 bitcoins every 10 minutes for the first four years after its creation. But here’s the catch: every four years, this reward is halved, marking a momentous event in the cryptocurrency world known as “Bitcoin Halving.”

The Halving Timeline

Let’s take a quick journey through the history of Bitcoin halvings to understand their significance:

- 2012 Halving: This marked the first halving, where the mining reward dropped from 50 BTC to 25 BTC per block.

- 2016 Halving: Four years later, the reward was reduced from 25 BTC to 12.5 BTC per block.

- 2020 Halving: In the most recent halving on May 11, 2020, the reward was slashed again, from 12.5 BTC to 6.25 BTC per block.

- 2024 Halving: The next awaited halving, set to occur in 2024, will further decrease the reward from 6.25 BTC to 3.125 BTC per block.

The Halving Effect on Bitcoin Prices

Supply and Demand Dynamics

In traditional economics, lower supply coupled with consistent demand drives prices higher. The Bitcoin halving operates on this fundamental principle. As the supply of new bitcoins diminishes with each halving, the potential for price appreciation becomes increasingly evident.

Historical Trends

A glance at Bitcoin’s price history reveals a compelling pattern. Significant price surges have followed each previous halving event due to inflation control. It’s not merely a coincidence; it’s the result of the fundamental economic forces in the Bitcoin ecosystem.

2024 Halving: What to Expect

With the next halving approaching at block 840,000, the anticipation among Bitcoin enthusiasts is palpable. While past performance doesn’t guarantee future results, historical trends suggest that the 2024 halving could trigger another remarkable price rally.

Conclusion: Seizing the Bitcoin Halving Opportunity

The Bitcoin halving countdown is not merely a spectator sport; it’s a reminder of the cryptocurrency’s unique economic design. As the supply of new bitcoins becomes scarcer, the potential for price appreciation grows. This phenomenon has historically marked the beginning of significant bullish trends in Bitcoin’s price.

Whether you’re a seasoned Bitcoin investor or just getting started, understanding the significance of the Bitcoin halving is crucial. It’s an opportunity to ride the waves of a revolutionary financial system changing how we perceive and transact with money. So, as we approach the 2024 halving, keep an eye on your Bitcoin holdings and prepare for what could be an exhilarating ride into the future of finance.