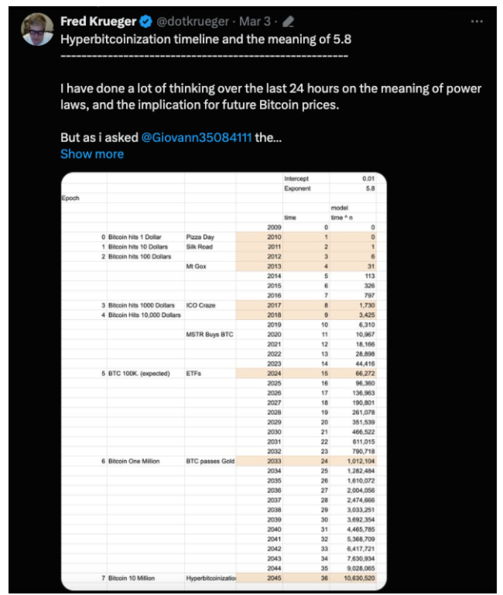

In the ever-evolving world of cryptocurrency, bold predictions often capture the imagination and skepticism of enthusiasts and skeptics alike. Among these, a fascinating forecast has emerged from a physicist who claims his ‘Power Law’ model predicts Bitcoin’s price reaching a staggering $10 million by the year 2045. This article delves into the intricacies of the Power Law model, the rationale behind this audacious projection, and the implications it holds for the future of Bitcoin and the broader cryptocurrency market.

Table of Contents,

The Essence of the Power Law Model

At its core, the Power Law model employed by the physicist is grounded in the complex interplay between market dynamics, adoption rates, and technological advancements. Unlike traditional financial models that often rely on linear assumptions, the Power Law model embraces the inherently non-linear nature of exponential growth. It posits that as Bitcoin’s adoption continues to penetrate global markets, its value will escalate in a non-linear fashion, mirroring the exponential growth patterns observed in technology adoption cycles.

The Path to $10 Million: Adoption as the Keystone

The physicist’s argument hinges on the concept of Bitcoin transitioning from a speculative asset to a universally accepted store of value and medium of exchange. This transition, driven by increasing institutional adoption, technological advancements in blockchain, and greater regulatory clarity, is expected to fuel demand exponentially. Furthermore, the model considers Bitcoin’s deflationary nature, with its capped supply of 21 million coins acting as a catalyst for value appreciation as demand outstrips supply.

Skepticism and Support: A Polarized View

Critics of the $10 million projection raise legitimate concerns regarding regulatory headwinds, technological hurdles, and market volatility. They argue that such a valuation overlooks potential regulatory clampdowns, scalability issues, and competition from other cryptocurrencies or digital assets. Moreover, detractors question the feasibility of widespread adoption, citing environmental concerns and the digital divide as barriers to Bitcoin’s universal acceptance.

Conversely, supporters of the Power Law model and the $10 million forecast point to historical precedents of exponential growth in technology adoption, such as the internet and mobile phones. They argue that Bitcoin possesses unique attributes, such as decentralization, security, and transparency, which position it favorably as a revolutionary financial instrument. Furthermore, the increasing interest from institutional investors and the entry of traditional financial players into the crypto space lend credence to the model’s optimistic outlook.

While the Power Law model offers a compelling vision of Bitcoin’s potential trajectory, the path to $10 million is fraught with uncertainties. Technological innovation, geopolitical factors, and shifts in consumer behavior will play critical roles in shaping Bitcoin’s journey. For investors and enthusiasts, the key lies in staying informed, adopting a long-term perspective, and navigating the volatile waters of the cryptocurrency market with caution and due diligence.

Conclusion

The physicist’s Power Law model, predicting Bitcoin’s ascent to $10 million by 2045, encapsulates the optimism and challenges inherent in the cryptocurrency domain. While the forecast may appear overly ambitious to some, it underscores the transformative potential of Bitcoin and blockchain technology. As we move closer to the predicted milestone, the debate surrounding Bitcoin’s valuation and its role in the future financial landscape will undoubtedly intensify. Regardless of the outcome, the journey promises to be one of the most intriguing episodes in the annals of financial history.