The Grayscale Bitcoin Trust (GBTC) has been in the spotlight for its persistent outflows in recent months, with investors redeeming shares at an unprecedented rate. However, a surprising twist has emerged – for the second consecutive day, GBTC outflows have slowed down. The cryptocurrency community is now left pondering whether this marks the end of the GBTC exodus or if it’s simply a temporary lull in a larger trend. In this article, we’ll delve into the data, examine the potential reasons behind this slowdown, and debate what this means for GBTC and the broader cryptocurrency market.

Table of Contents,

The GBTC Exodus Phenomenon

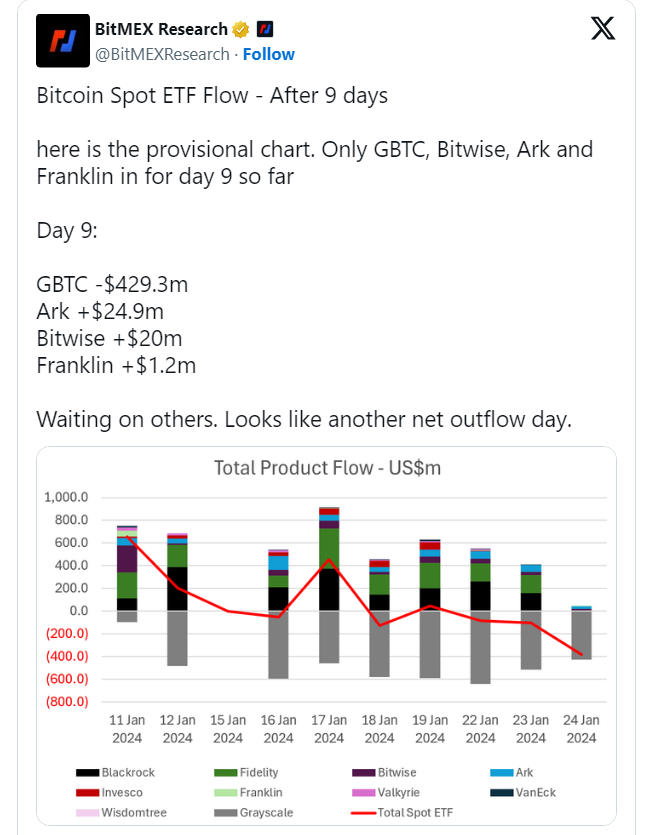

GBTC has long been a preferred investment vehicle for those seeking exposure to Bitcoin without directly holding the cryptocurrency. In recent months, GBTC outflows have dominated headlines, as investors chose to redeem shares, often citing concerns about the discount to net asset value (NAV) as a motivating factor.

A Puzzling Development: Slowing Outflows

The recent data reveals that GBTC outflows have not only halted their upward trajectory but have actually slowed down for two consecutive days. This unexpected shift has raised eyebrows and triggered debates across the crypto community.

Exploring Possible Reasons

Several factors could be influencing this slowdown. Investors might be reassessing their GBTC holdings as the NAV discount gap closes, or they could be considering alternative avenues for Bitcoin exposure. Additionally, market volatility and macroeconomic factors may be playing a role. The cryptocurrency market is no stranger to surprises, and this slowdown is no exception.

Impact on the Cryptocurrency Landscape

GBTC has traditionally been seen as a bellwether for institutional interest in Bitcoin. Any significant deviation from the established trend can send ripples through the crypto market. The recent slowdown in outflows has led to discussions about its implications for the broader cryptocurrency landscape.

What Lies Ahead?

The cryptocurrency market is known for its unpredictability, and predicting its future moves is a challenging task. Whether the slowdown in GBTC outflows is a sign of a fundamental shift in investor sentiment or a brief pause in the ongoing trend remains uncertain. Market participants will be closely monitoring developments for clues about what the future holds for GBTC and the crypto market at large.

Conclusion

The unexpected slowing of GBTC outflows for two consecutive days has added a layer of uncertainty to the cryptocurrency landscape. It prompts us to question whether this is the end of the exodus or merely a pause in the ongoing trend. As the crypto market continues to evolve, adaptability and a keen understanding of market dynamics will be paramount for investors and observers alike.