In a financial landscape increasingly influenced by the integration of cryptocurrencies, the discussion surrounding spot Ether ETFs has reached a pivotal moment. Coinbase, a leading figure in the cryptocurrency exchange domain, has positioned itself as a vocal advocate for the approval and adoption of spot Ether ETFs. This stance comes amid warnings from analysts about the potential ‘concentration risk’ such products could introduce to investors and the broader market. As this debate unfolds, it’s crucial to dissect the arguments on both sides to understand the implications of introducing spot Ether ETFs into the investment mainstream.

Table of Contents,

Coinbase’s Argument for Spot Ether ETFs

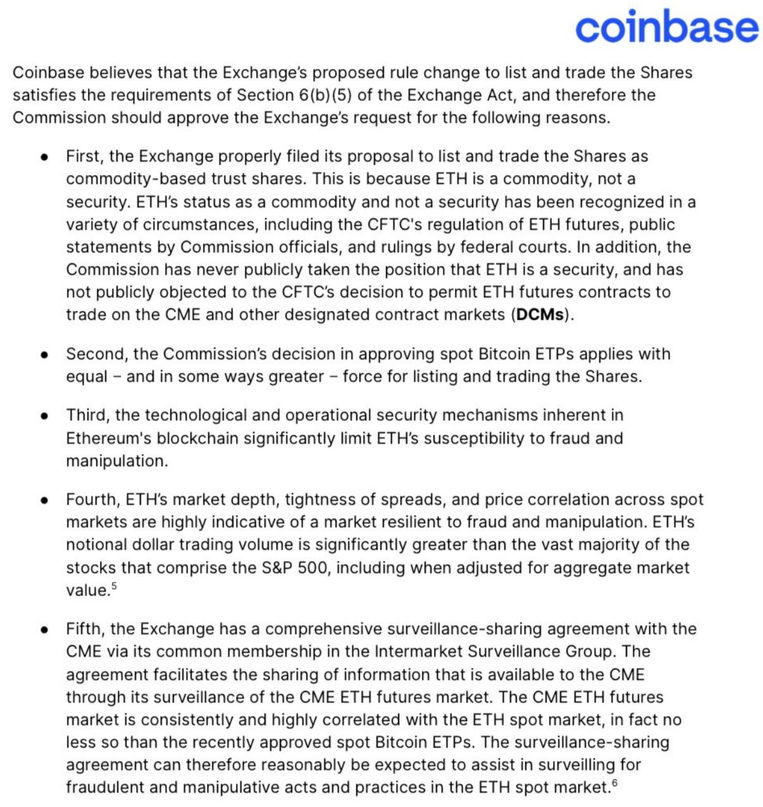

Coinbase’s advocacy for spot Ether ETFs is rooted in a belief in democratizing access to cryptocurrency investments and enhancing market maturity. The company argues that spot Ether ETFs would provide investors with a regulated, transparent, and efficient means of gaining exposure to Ethereum without the complexities and risks associated with direct cryptocurrency ownership. Furthermore, Coinbase suggests that such ETFs could serve as a catalyst for broader institutional adoption of cryptocurrencies, thereby increasing liquidity and stability in the crypto markets.

Analysts Warn of Concentration Risk

Conversely, some financial analysts express concern over the ‘concentration risk’ associated with spot Ether ETFs. This term refers to the potential for a significant portion of investments to be focused narrowly on Ethereum, possibly exacerbating market volatility and exposing investors to heightened systemic risk. Critics argue that the nascent nature of the cryptocurrency market, coupled with its historical volatility, necessitates a cautious approach to integrating such products into conventional investment portfolios. They fear that without sufficient diversification, investors might face amplified losses during periods of market downturn.

Balancing Innovation with Investor Protection

The debate over spot Ether ETFs encapsulates a broader discussion on balancing innovation with investor protection. Proponents of Ether ETFs, like Coinbase, view these products as an essential step toward the maturation of the cryptocurrency market, offering investors safer and more accessible investment options. On the other hand, skeptics caution against rushing into such developments without fully understanding the potential risks and ensuring adequate safeguards are in place.

Regulatory Perspective and Market Impact

The regulatory perspective on spot Ether ETFs remains a critical factor in this debate. Regulatory bodies, tasked with protecting investors while fostering innovation, are scrutinizing these proposed products to strike the right balance. The outcome of this regulatory deliberation will significantly impact the cryptocurrency market, potentially setting precedents for how similar products are viewed and regulated in the future.

Conclusion

The discussion surrounding spot Ether ETFs represents a microcosm of the broader challenges and opportunities presented by the integration of cryptocurrencies into the global financial system. As Coinbase champions the cause for these ETFs, and analysts warn of potential risks, the path forward requires a careful consideration of the benefits of innovation against the imperative of investor protection. Regardless of the immediate outcome, this debate underscores the evolving nature of investment in the digital age, highlighting the need for ongoing dialogue, regulation, and education to navigate the complexities of cryptocurrency investments.