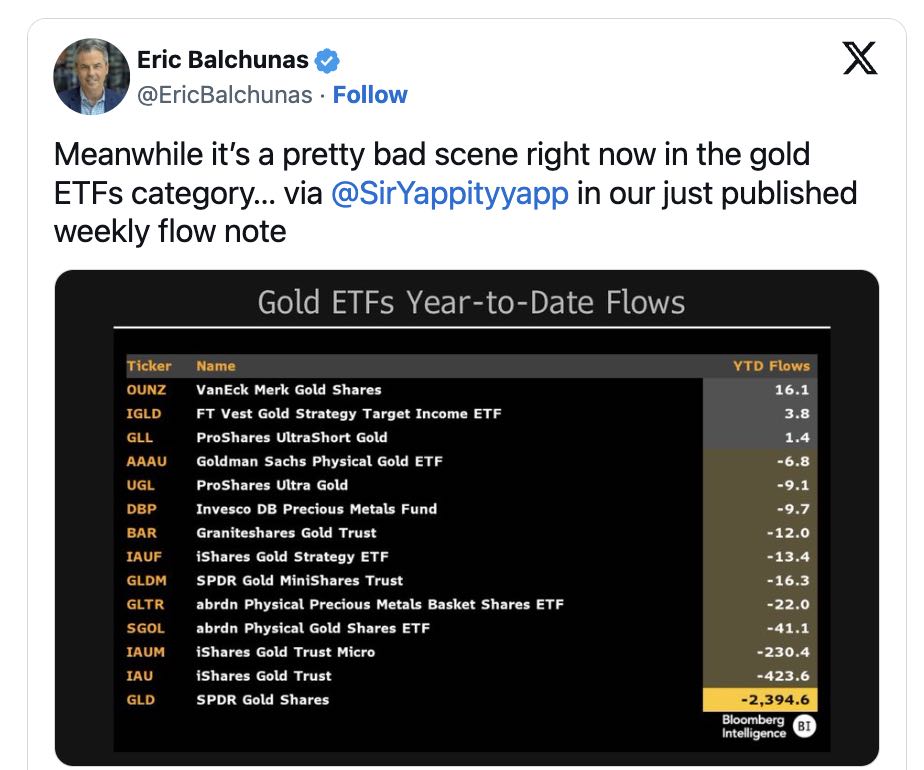

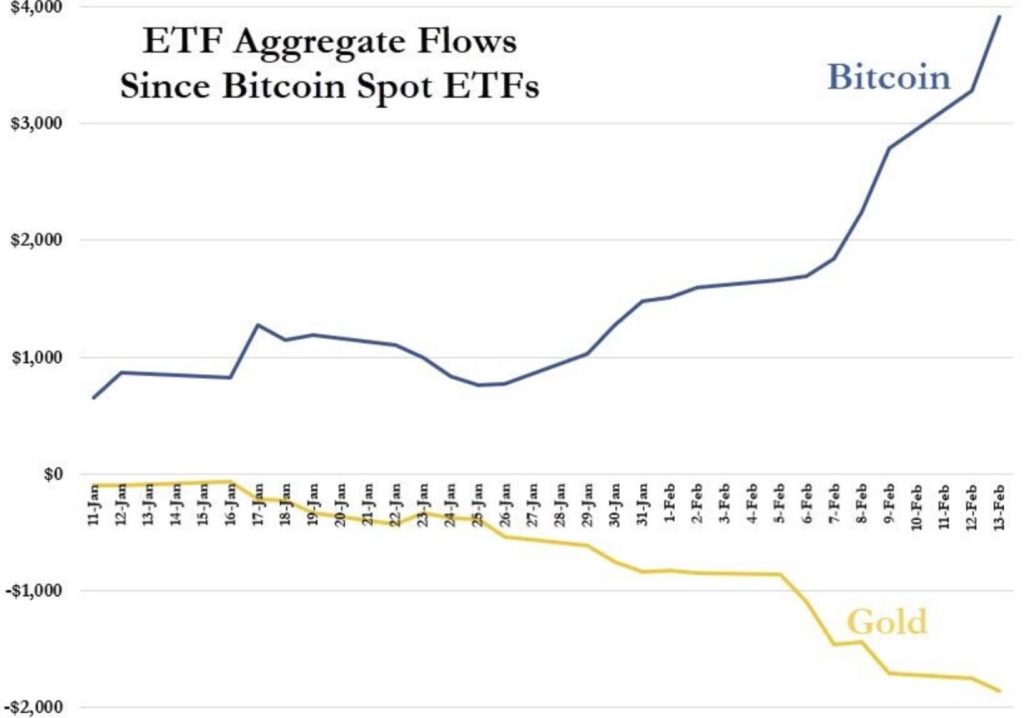

As we navigate through 2024, the investment landscape is witnessing a remarkable shift. Gold, traditionally considered a safe haven asset, has seen its ETFs bleed $2.4 billion so far this year. In stark contrast, Bitcoin ETFs are riding a wave of unprecedented volumes, setting new records in the process. This divergence has sparked intense debate among investors and market analysts alike. Is this trend a temporary market anomaly or a sign of a deeper, more fundamental shift in investor sentiment? This article for decentrahacks.com delves into the arguments on both sides of the divide, exploring the implications of these developments for the future of investment.

Table of Contents,

The Case for Bitcoin ETFs

Proponents of Bitcoin ETFs argue that the record volumes are indicative of a broader acceptance of digital currencies as legitimate investment vehicles. They point to several factors driving this surge:

- Diversification: Investors are increasingly looking to diversify their portfolios beyond traditional assets. Bitcoin ETFs offer an accessible entry point into the cryptocurrency market without the complexities of direct crypto ownership.

- Inflation Hedge: With concerns about inflation on the rise, many see Bitcoin as ‘digital gold,’ offering similar protective benefits against currency devaluation while possessing the potential for higher returns.

- Institutional Adoption: The launch of Bitcoin ETFs has facilitated institutional investment in cryptocurrency, lending credibility to the asset class and attracting significant capital inflows.

The Defense of Gold ETFs

Despite the current outflows, supporters of gold ETFs believe that the asset’s fundamental value proposition remains intact:

- Proven Track Record: Gold has a centuries-long history as a store of value and hedge against economic uncertainty. This track record, they argue, cannot be easily dismissed in favor of a comparatively new asset like Bitcoin.

- Volatility Concerns: Critics of Bitcoin point to its price volatility as a significant risk factor that gold does not possess to the same extent, making gold ETFs a more stable investment choice during turbulent times.

- Regulatory Clarity: The regulatory environment for Bitcoin and other cryptocurrencies remains uncertain in many jurisdictions, posing risks that do not affect gold to the same degree.

Implications for Investors

The contrasting fortunes of gold and Bitcoin ETFs in 2024 raise important questions for investors:

- Risk Appetite: The choice between gold and Bitcoin ETFs may ultimately come down to an investor’s risk tolerance. Those with a higher risk appetite may find the potential rewards of Bitcoin ETFs more appealing, while conservative investors may prefer the stability of gold.

- Market Sentiment: The shift towards Bitcoin ETFs reflects broader market sentiment favoring technological innovation and digital transformation. However, sentiment can change, and the sustainability of this trend is not guaranteed.

- Long-Term Outlook: While the current momentum favors Bitcoin ETFs, the long-term outlook remains uncertain. Factors such as regulatory changes, technological advancements, and macroeconomic trends will likely play a critical role in shaping the future of both asset classes.

Conclusion

The early months of 2024 have underscored a pivotal moment in the investment world, as gold ETFs face significant outflows while Bitcoin ETFs achieve record volumes. This shift may reflect changing investor preferences and a broader acceptance of digital currencies as legitimate assets. However, the debate between the relative merits of gold and Bitcoin as investment choices is far from settled. Investors must navigate this evolving landscape with an informed perspective, balancing the potential for high returns against the risks inherent in each asset class. As the year progresses, the investment community will be keenly watching how these trends develop, seeking to understand whether we are witnessing a temporary realignment or a fundamental transformation in the world of investment.